Executive Summary

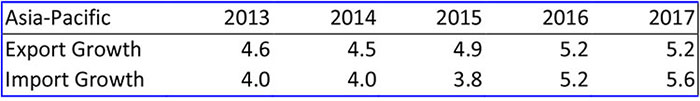

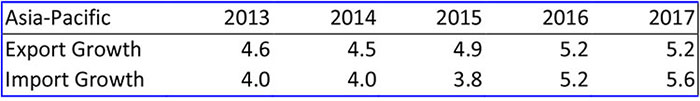

Trade growth in the Asia-Pacific is expected to post a moderate recovery in 2015 with exports growing at 4.9 percent and imports at 3.8 percent, down from 4.5 percent and 4.0 percent respectively in 2014. However, these rates are significantly lower than trade growth in the years leading up to the Great Recession, causing some to wonder whether trade growth relative to GDP growth has reached a peak.

The implication of a narrower gap between trade growth and GDP growth is that the external sector will make a lower contribution to the broader economy than is the past. This is not necessarily a bad thing as rebalancing in regional economies was needed to avoid a recurrence of unsustainable current account imbalances across the region. However, creeping protectionism and a general lack of momentum on trade liberalization could undermine the ability of regional economies to continue to benefit from the integration process.

While the regional policy community is in agreement with forecasts for muted trade growth over the next 12 months, they are much more bullish on the prospects over the next 5 years. Sixty-three percent of respondents to PECC’s survey expect either stronger or much stronger trade growth for their economies over the next 5 years.

- At the same time, regional opinion-leaders highlighted key policy concerns for governments to address through APEC. These were:

- The facilitation of participation of SMEs in global value chains

- The achievement of the Bogor Goals and the Free Trade Area of the Asia-Pacific (FTAAP)

- Services sector reforms and liberalization

- The design of trade policy in response to global value chains

- How economies can move to upgrade their participation in global value chains

While service sector reforms and liberalization were rated as the 3rd highest priority for APEC to address, regulatory measures affecting service sectors such as telecoms, finance and transport were ranked as the top trade impediments.

These findings highlight the critical importance of the services sector to trade in the 21st century. Moreover, analytical work is also showing the importance of competitive service supply in goods and agriculture as well because of the way in which global value chains operate.

The regional policy community continues to see trade and integration as beneficial to their economies. However, for some, there was a view that those benefits have been limited due to supply side constraints. Addressing those constraints through polices that promote better infrastructure, education and SME participation would not only provide a boost to the region’s flagging trade growth but also make the integration process more inclusive.

In order to make progress towards the Free Trade Area of the Asia-Pacific (FTAAP), regional economies need to complete negotiations on identified pathways – the Trans-Pacific Partnership (TPP) and Regional Comprehensive Economic Partnership (RCEP). However, this alone is insufficient. Low utilization rates of existing trade preferences point to the need to rethink how these agreements are constructed. Work to ensure that the design of an FTAAP would take into account how global value chains operate was identified as a key step towards its achievement.

While there are concerns about the future of trade growth, trade can continue to play a significant role in driving regional growth if progress is made on the policy front. This requires a focus on the services sector as well as ensuring that policies take into account how global value chains operate. Trade policy, however, needs to be accompanied by significant supply side improvements to ensure that the integration process is more inclusive.

Next >>