Section 3: The Future of Regional Cooperation

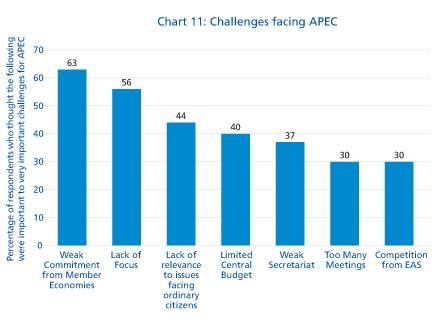

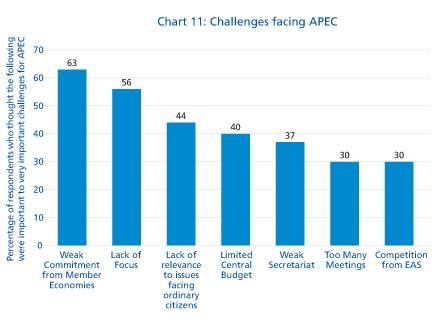

According to the survey, the principal challenges facing APEC are "weak commitment from member economies", and "lack of focus", which were the choices of 63 percent and 56 percent of respondents respectively. Of potentially greater concern is the fact that 44 percent of respondents feel APEC's greatest challenge is its "lack of relevance to issues facing ordinary citizens".

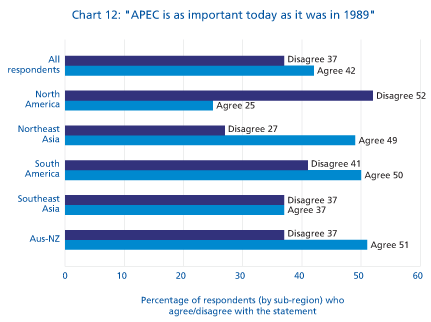

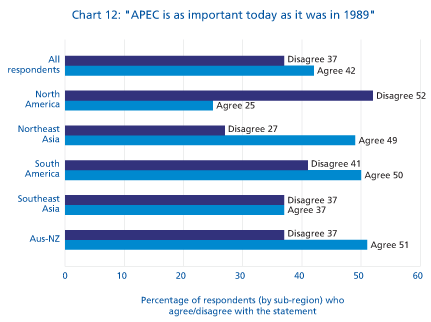

Furthermore, nearly 40 percent of respondents identified APEC's "limited central budget" and "weak secretariat" as major challenges for the regional forum. When asked if "APEC is as important today as it was in 1989", only 42 percent of respondents agreed. Support for this statement was the lowest among North American respondents (25 percent) and highest in Australia/New Zealand (51 percent).

3.1 Sub-Regional Integration

East Asian Regionalism Rising

One by-product of trade and investment liberalization in the last two decades has been the greater integration of East Asian economies. More than half the trade that takes place in East Asia is conducted among East Asian economies. Until recently, East Asian integration was principally driven by business decisions. Since the Asian financial crisis, however, there has been a move to forge institutional arrangements for deeper integration in the region, in part as a response to deeper economic integration in Europe and the Americas.

Only 27 percent of respondents agreed with the statement "The East Asia Summit will eventually overshadow APEC"

Examples include the "ASEAN plus Three",China's initiative for a free trade area with ASEAN, Japan's proposed "Comprehensive Economic Partnership in East Asia," and the "East Asia Summit" process which includes not only ASEAN and Northeast Asia, but also India,Australia, and New Zealand.(see sidebar: East Asian Regionalism: From Integration to Identity?)

Respondents to our survey were generally not concerned about the East Asia Summit as a potential threat to APEC, which is consistent with the lukewarm assessment of the EAS that came across in other questions. Only 27 percent of respondents agreed with the statement "The East Asia Summit will eventually overshadow APEC".

East Asian Regionalism: From Integration to Identity?

East Asia is on a path of regional integration that has been led principally by market forces. Trade and investment, particularly foreign direct investment (FDI) have been the main drivers. It is important to recognize, however, that the expansion of intra-regional trade in East Asia has not been at the expense of trade with the rest of the world.

The liberalization of trade and investment in many East Asian economies took off at a time when outward investment from Japan was increasing rapidly, starting in the mid 1980s. The combination of push and pull factors resulted in a sharp expansion of intra-regional trade and investment, and the emergence of a "trade-FDI nexus", namely the simultaneous expansion of trade and FDI, and the mutual reinforcement of both economic drivers. This phenomenon has been accompanied by the fragmentation of production in many industries, resulting in complex supply chains that involve multiple economies in the region.

East Asia is beginning to establish an institutional identity. The idea of an EAFTA(East Asian Free Trade Area) is on the agenda of the ASEAN Plus Three (APT) process. The East Asian Vision Group (EAVG) raised the possibility that EAFTA be formed through a building block approach and by consolidating existing bilateral and sub-regional agreements in the region.ASEAN is at the center of this process as has embarked on bilateral initiatives with the three partners in Northeast Asia as well as with Australia and New Zealand, and with India. The goal of the APT process is the creation of an "East Asian Community".

A second vehicle for the promotion of an East Asian community was created in December 2005, in the form of the East Asia Summit (EAS). The EAS has a broader membership (APT plus Australia, India and New Zealand) and is a forum for dialogue not only on economic issues but also on political and strategic questions. The Kuala Lumpur Declaration describes the EASas"anopen, inclusive, transparent and outward-looking forum", with ASEAN as the driving force

Financial Cooperation Deepening

East Asian economies have implemented a series of measures to enhance their resilience to external shocks, including financial sector restructuring, resolution of corporate debt, and the adoption of greater exchange rate flexibility among the crisis-affected economies.

Regional financial cooperation has also been strengthened in recent years, under the aegis of the ASEAN+3 finance ministers. Key measures include:

- Regional Surveillance: Through the ASEAN+3 Economic Review and Policy Dialogue (ERPD) process, finance ministers meet regularly to review financial and economic issues affecting member countries. Many members have set up national surveillance units for economic and financial monitoring and are developing their own early warning systems.

- Reserve Pooling: In May 2005, finance ministers agreed to substantially strengthen the Chiang Mai Initiative (CMI) by increasing bilateral currency swaps, linking them to regional economic surveillance, raising the level of disbursement permitted without an IMF program from 10 percent to 20 percent, and incorporating a collective decision-making mechanism for swap activation (a step towards multilateralization). The total swap size reached US$75 billion as of May 2006. In May 2006, finance ministers tasked their deputies to further study various possible options toward an advanced framework of the regional liquidity support arrangement.

- The Asian Bond Markets Initiative (ABMI). The Asian Development Bank has been fostering a process of regional bond market development.Current discussions include the creation of multi-currency bonds, establishment of a regional credit guarantee mechanism, exploration of an Asian settlement system, strengthening Asian credit rating agencies in conjunction with Basel II implementation, and development of Asian Bond Standards. For its part, PECC has been working with private sector partners on bond market development in areas not covered by the ADB. These include providing private sector input into policy formulation, regional aspects of insolvency and informal workouts, and promoting awareness and interest in regional bond markets on both sides of the Pacific.

Further work is needed in regional financial cooperation, not only for the benefit of the region, but also for the stability of the global financial system as a whole. The region's experience of excess savings is likely to continue for some time, and governments should seek to use measures to allocate them optimally between regional investment and global investment. The appropriate measures might include:

- Further enhancing resilience and soundness of national financial systems so that national savings are channeled to productive investment;

- Prudently managing financial globalization at the national level (avoiding volatile capital flows and adopting sustainable exchange rate arrangements); and

- Strengthening regional financial cooperation to reduce financial vulnerabilities and to prevent and manage financial crises through regional economic surveillance, regional reserve pooling, and development of local-currency bond markets.

First Steps to a Common Asian Currency?

Since October 2005, the Asian Development Bank has been working on the idea of an Asian currency index, which is a tracking mechanism for a weighted average of Asian currencies. The creation of this index, also known as the Asian Currency Unit (ACU), has contributed to the debate on coordination of exchange rate policy in Asian economies.

The ACU can be used as an indicator of how Asian currencies are moving collectively vis-a-vis key external currencies, such as the U.S. dollar and the Euro, as well as how each Asian currency is moving against a regional benchmark. The ACU is not currently used as a policy instrument for Asian governments, but could begin to perform this function as the importance of intra-regional trade and investment expands, and as financial cooperation deepens.

The ACU index also has the potential for use in denominating the prices of bonds and other financial instruments issued in the region. In the event of a disorderly unwinding of global payments imbalances, an ACU has the potential to serve as a regional benchmark for exchange rate realignment.

The notion of a common Asian currency is still very far off, but the ACU represents a few small steps towards closer cooperation among Asian governments on monetary and exchange rate issues.

Integration in the Americas at an Impasse

Deeper economic integration in the Americas appears to have stalled, with the negotiations for a Free Trade Area of the Americas (FTAA) at an impasse. NAFTA is now well established but it is not without problems particularly in the area of dispute settlement. It is unclear if the current discussions on a Security and Prosperity Partnership (SPP) covering the United States,Canada, and Mexico will amount to another avenue for deeper economic integration in North America, and if it will be based on openness to the rest of the world, or on a fortress mentality.

3.2 Membership in APEC

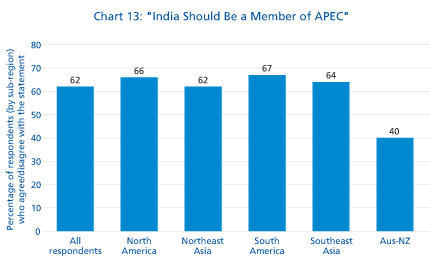

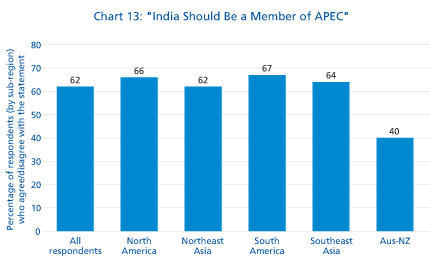

A ten-year moratorium on membership expires in 2007. Non-APEC PECC members — Colombia and Ecuador are obvious candidates. So are associate member Mongolia and the non-APEC members of ASEAN. India has also been knocking at the door of APEC since the early 1990s and was turned down at least three times, most recently in 1997, however, it is unclear if a)APEC will extend the moratorium, and b) India is still interested in becoming a member. Despite a historical chariness about the role of India in Asia Pacific institutions, a robust majority of respondents (62 percent) now believes that the emerging South Asian giant should become a member of APEC.

The findings of this survey suggest that the question of Indian membership deserves serious attention. Views about Indian membership, however, vary across the region. Whereas around 65 percent of respondents from North America, Southeast Asia and South America believe India should be included in APEC, only 40 percent of experts from Australia and New Zealand held the same opinion.

In an acknowledgement of India's growing economic clout, 74 percent of respondents from Southeast Asia and 76 percent from Northeast Asia believe that India should be a member of any Asia Pacific regional organization.

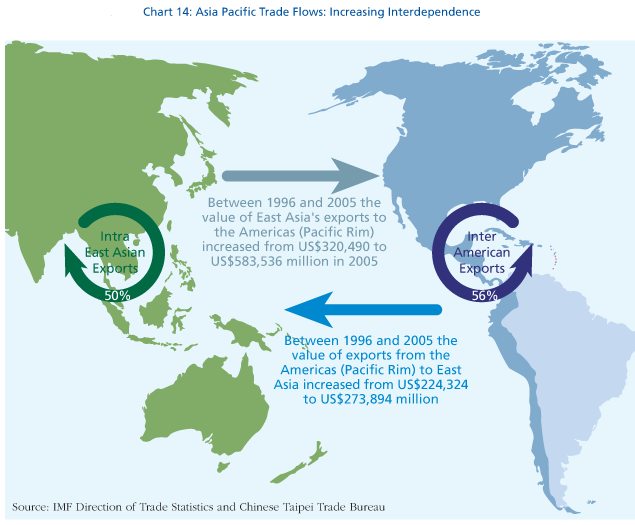

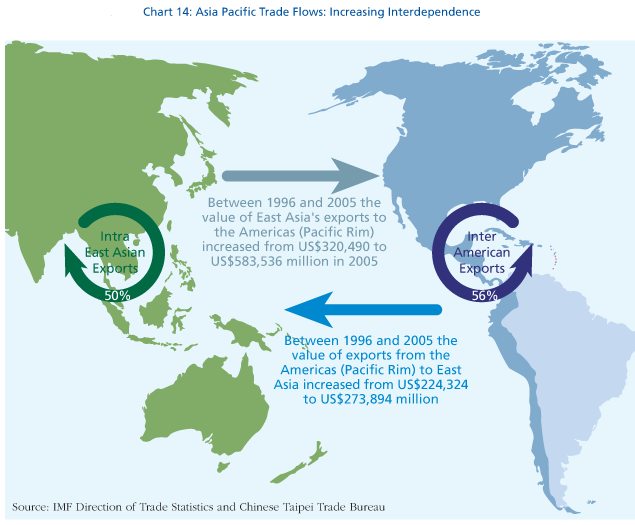

3.3 Trans-Pacific Ties

A defining feature of APEC-and PECC - is the trans-Pacific composition of its membership. The fact that leaders of economies from both sides of the Pacific meet annually under the auspices of APEC is an essential political anchor for trans-Pacific cooperation across a broad range of issues. Despite the rise in intra-Asian trade and investment, the health of trans-Pacific ties continues to be critically important for the world economy. East Asian integration is characterized by its outward orientation, with much of the intra-regional trade in intermediate products leading to final exports intended for the rest of the world.

APEC should embrace the discussions on new regional architecture as an opportunity to reform and to renew the organization

The United States in particular is still a very important source of final demand for products from Asia, especially China, and trans-Pacific investment has been an important factor in the expansion of production networks in Asia. East Asia's exports to the United States in 2005 totaled over US$500 billion, close to 90 percent of all of Asia's trans-Pacific trade and more than double the United States'exports to Asia.

The massive current account deficit between the United States and Asia has a financial counterpart in the substantial holdings of U. S. treasury bills by Asian central banks. There is also a substantial volume of foreign direct investment from Asia into the Americas. Japanese companies have led the way with their extensive holdings in the automobile sector, and Chinese enterprises have more recently shown interest in acquisitions throughout North and South America, especially in the resource sector.

There is, however, considerable concern on the Asian side of the Pacific that the North American countries, particularly the United States, give less attention to APEC than they once did. This is in part because of the heavy emphasis in the United States on the Middle East and on security-related issues following the September 11 attacks. While these are very important issues,Asia has by far the greater impact on America's society and future. We believe the United States needs to clarify and revitalize its APEC commitments.

APEC Should Embrace Discussions on New Regional Architecture

APEC may or may not be in a position to directly address the challenges to economic growth in the previous sections, but the need for Asia Pacific economic cooperation is as important as ever. It used to be said that APEC has a future because it is the only trans-Pacific regional institution and therefore cannot be allowed to fail.

As economies on both sides of the Pacific Rim contemplate new forms of regional and sub-regional architecture,APEC can no longer be complacent. On the contrary,APEC should embrace the discussions on new regional architecture as an opportunity to reform and to renew the organization.

As the results of PECC's survey show, opinion-leaders appreciate the continued importance of APEC, but are doubtful about the commitment of member economies to the regional forum.APEC leaders meeting in Hanoi should send a clear message to dispel such doubts, and then follow up with the political will, financial resources, and institutional support to prove the doubters wrong.

<< Previous

Next >>