Chapter 3 - ASIAN AND TRANS-PACIFIC INITIATIVES IN REGIONAL INTEGRATION*

*Peter A. Petri (Brandeis University, East-West Center, and Peterson Institute for International Economics) and Tri Thanh Vo (Central Institute of Economic Management). The views expressed are those of the authors and do not necessarily reflect those of institutions with which they are affiliated. The authors thank Eduardo Pedrosa, Ambassador Wu Zhenglong, and Charles Morrison for helpful comments on an earlier draft.

The nearly two decades since the Uruguay Round was concluded in 1993 represent the longest stretch of time without a new global trade agreement under the GATT/WTO system. Regional and bilateral trade agreements are now filling this vacuum. In the Asia- Pacific region, two dynamic, high profile initiatives have emerged: an Asian track of negotiations centered on ASEAN, and a trans- Pacific track centered on the proposed Trans-Pacific Partnership (TPP) agreement, which also includes the United States and other economies from the Americas.

Where will these tracks lead? Are they pathways to a Free Trade Area of the Asia Pacific (FTAAP), as APEC Leaders hope? Are they the seeds of tense economic rivalry between China and the United States, as some pundits fear? How will they affect ASEAN’s own integration efforts and its “centrality” in regional cooperation? The answers matter; the Asia-Pacific region is the world’s largest trading zone and its most promising driver of long-term economic growth.

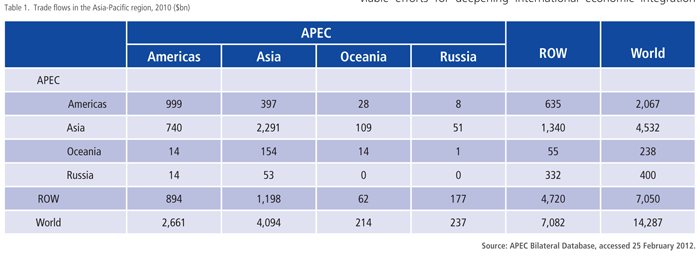

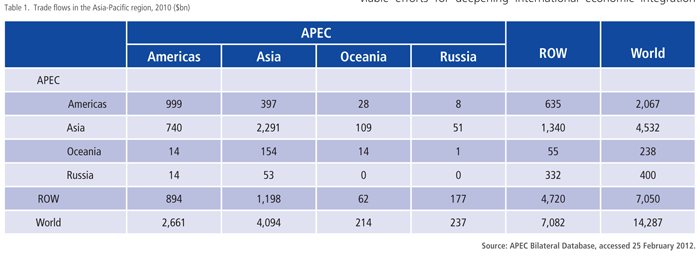

Of the world’s $14.3 trillion in trade in 2010, 67 percent (all but $4.7 trillion) involved APEC economies – a useful working definition of the Asia-Pacific region – as either exporters or importers or both (See Table 1). Asia-Pacific trade is also tremendously creative: it has facilitated the development of modern production chains; enabled labor-rich and resource-poor economies to exchange manufactured goods for primary materials; allowed advanced and emerging economies to exchange high-technology and laborintensive products and services; and made it possible for economies to move into new industries while passing older industries on to new “flying geese.”

These extraordinary results have been achieved mostly without formal trade agreements, although the WTO system has played an important role. China and Vietnam, two of the region’s most dynamic exporters, dramatically boosted their trade following accession to the WTO in 2001 and 2007, respectively. Now a new wave of regional trade agreements and negotiations on both the Asian and TPP tracks are creating new opportunities as well as sources of uncertainty for Asia-Pacific trade.

The Asian and TPP negotiating tracks have similarities and differences. Both see trade liberalization as a positive-sum game. Both seek to reduce at-the-border and behind-the-border barriers to trade and investment between the members, to generate increased output growth, exports and employment. The two tracks also incorporate elements of open regionalism; they represent intermediate steps towards wider and more comprehensive integration pacts. Finally, both Asian and TPP agreements constitute viable efforts for deepening international economic integration while global negotiations are stalled. Successful negotiation and implementation of these agreements would generate progress on international economic integration and perhaps help push global negotiations back on track.

Nevertheless, the Asian and TPP tracks also differ in terms of motivation. Asian agreements were initiated after the Asian financial-monetary crisis to promote intra-regional cooperation and to improve the region’s capacity to deal with common adverse economic shocks, at a time when APEC and major partners provided weak support. The TPP (then the P4) was first launched by four small APEC economies to accelerate progress towards APEC’s goals of free and open trade and investment. The United States became involved in 2009, to help promote the dynamic development of Asia-Pacific trade and to sustain its own economic engagement in the region. The challenge to policy makers and analysts is to determine whether, and how, the two tracks can provide pathways toward a truly free regional trading system.

In Chapter 2, PECC’s annual survey of regional opinion leaders finds that respondents consider regional economic integration to be the most important focus for regional policy given the difficult global macro-economic environment. The Asian and TPP tracks (defined as the ASEAN+3 and TPP discussions) receive roughly equal support from respondents, and are both thought to be promising pathways to the FTAAP. However, their chances for success are not judged to be high – only 38 percent and 34 percent for the Asian and TPP tracks, respectively. More opinion leaders expect success in ASEAN integration (51 percent), but many fewer in the Doha Round (8 percent).

The Asian Track

Somewhat surprisingly, the Association of Southeast Asian Nations (ASEAN), rather than the giant Northeast Asian economies, has emerged at the center of Asian integration efforts so far. ASEAN has been in the driver’s seat in several concentric circles of cooperation, including the ASEAN Regional Forum (ARF) and the East Asia Summit. Its central role is explained by three factors. First, the development of Southeast Asia is in the interest of all major economies, including the US, EU, China and Japan. Second, ASEAN provides a “second best” mechanism for cooperation when more direct interactions among major economies are hampered by history or geopolitics. Third, the importance of integrating ASEAN’s smaller economies provides an incentive for developing mechanisms and expertise in economic cooperation.

ASEAN’s centrality in trade negotiations was given a boost by an agreement with China in 2002, leading to a full ASEAN-China FTA in 2010. This initiative has been followed by Japanese and Korean agreements, and eventually by agreements with India, Australia and New Zealand.

These “plus one” initiatives have generated interest in wider regional agreements. In 2004, ASEAN+3 economic ministers commissioned a feasibility study to establish an East Asia FTA (EAFTA). While the commissioned experts and some leaders recommended an early, high-standard, comprehensive agreement, there was little follow-up. Meanwhile, on the political-strategic side, ASEAN launched the East Asian Summit (EAS) in 2005, adding Australia, New Zealand and India. Shortly thereafter, the Japanese trade minister proposed a free trade agreement based on that grouping at the 2007 Summit. For a while, competition between the ASEAN+3 (backed by China) and ASEAN+6 (backed by Japan) proposals blocked progress, but at the 2011 Bali Summit China and Japan agreed to move forward with the two frameworks in parallel. ASEAN has since begun work on a general template for regional integration (the so-called ASEAN++ model) that would harmonize existing ASEAN agreements and permit others to join. This effort could transform the ASEAN-centric process into a building block toward a larger Asia-Pacific free trade area.

FTAs of varying quality now connect ASEAN with all six potential regional partners, but the critical missing piece is an FTA among China, Japan and South Korea. These three economies completed a study of a trilateral FTA in 2011, concluded a trilateral investment agreement, and announced that FTA negotiations would begin in 2012.

The Trans-Pacific Track

The vision of Asia-Pacific (or trans-Pacific) economic integration dates back to a 1965 proposal for a Pacific Free Trade Area, which led to the convening of the Pacific Trade and Development Forum (PAFTAD) in 1968 and eventually the quasi-official Pacific Economic Cooperation Council (PECC) in 1980. These efforts set the stage for the governmental Asia Pacific Economic Cooperation (APEC) forum that was established in 1989. Some early supporters of APEC had expected that it would lead to formal trade agreements, but as a voluntary process, it has settled on non-binding approaches focused on trade and investment facilitation. APEC has encouraged “pathfinder” initiatives among sub-groups, and the Trans-Pacific Strategic Economic Partnership created by Brunei, Chile, New Zealand and Singapore in 2005 (also known as the P4) has emerged as a prominent example of such efforts.

The transformation of the P4 into TPP negotiations was catalyzed by the U.S. Bush administration’s decision to enter into negotiations with P4 members in February 2008. Australia, Peru and Vietnam announced their intention to join later in 2008. The pace of activity accelerated in late 2009, when President Obama made the TPP a centerpiece of his new trade policy at the Singapore APEC meeting. Malaysia joined the negotiations in October 2010. At the APEC leaders’ meeting in 2011 the negotiators issued an outline of the agreement and Canada, Japan and Mexico expressed their intentions to join. In June 2012, Canada and Mexico were formally invited to join the negotiations. Japan’s involvement is still uncertain at this time, but it is now clear that at least 11 but perhaps 13 or more Asia-Pacific economies (many expect Korea to join at some point) are likely to be involved. As of July 2012, 13 rounds of negotiations have been held, each reportedly involving 400 or more negotiators.

The TPP could represent a breakthrough in merging existing trade agreements since there are 24 bilateral or regional agreements among the economies now negotiating the TPP. A successful TPP agreement would begin the complex process of consolidating the existing “noodle bowl” of rules and agreements that have emerged over the last decade. In the best scenario, it might eventually lead to a region-wide Free Trade Area of the Asia Pacific (FTAAP). The FTAAP was strongly pushed by some members of the APEC Business Advisory Council in 2006, and has appeared in several APEC Leaders’ Declarations. The 2010 Declaration identified the EAFTA, CEPEA and the TPP as possible pathways to this goal (APEC 2010).

Contrasting Templates

The Asian and TPP tracks differ in issues and membership. Asian agreements typically seek gradual liberalization, while the TPP aims to create a comprehensive, “21st century” template for economic partnerships. Asian agreements are usually more willing to accommodate exceptions (such as in agriculture or services) and to avoid imposing constraints on the domestic regulations of economies at different levels of development and with different political systems. The TPP, by contrast, seeks to develop common, high quality rules to restrict even “behind-the-border” measures that interfere with international commerce (albeit long transition periods might be allowed for some developing economies or sensitive sectors).

To a large extent, the proposed templates reflect the contrasting sectoral advantages of emerging economies and advanced economies. The Asian track is focused on reducing impediments to goods trade, mainly in manufacturing industries, while the TPP track is also focused on rules for service trade, investment, intellectual property rights and several other areas of economic and political interest. The templates are considered important by economies not only because of their direct impact, but also because they are likely to affect future regional and perhaps global trading rules. No economy can benefit from dividing the region into blocks, but economies naturally favor rules that improve the terms of trade for their strongest sectors. A template with strong rules for the leading sectors of both emerging and advanced economies is ultimately ideal, since it promotes more trade among them.

The tracks also differ in membership. At least for now, the Asian track excludes the Americas, while China and some other Asian economies are not participating in the TPP negotiations. Much has been made of this difference, but it does not have to be permanent, and it seems to be a pragmatic accommodation of current economic and political realities. However beneficial an immediate, region-wide agreement might be, its prospects of success would be slight – no better than those of the Doha Round. China, the United States and all other economies would be unlikely to agree on many issues covered by a comprehensive agreement, including competition policy, trade remedies, services liberalization, the protection of intellectual property, technology exports, labor, environment, and so on. And things could get even more complicated if domestic politics forced additional financial and social issues onto the agenda.

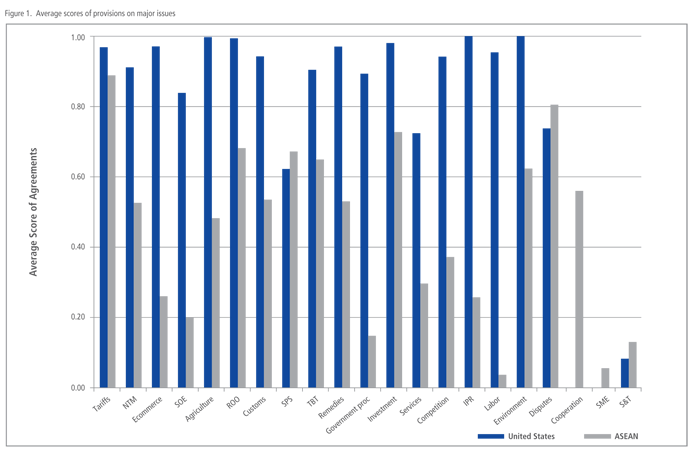

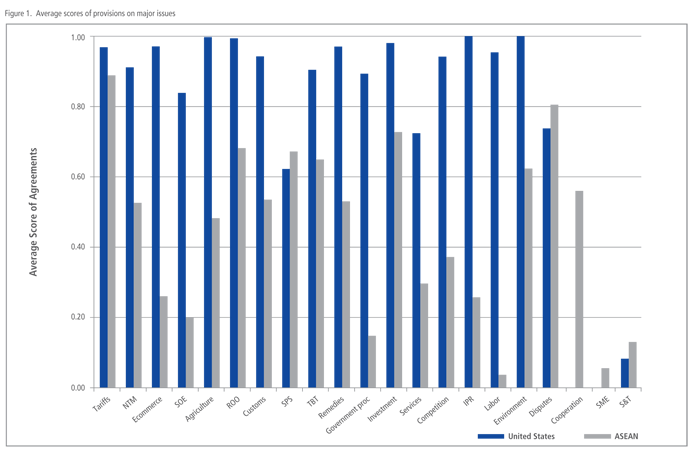

Systematic differences in templates can be also found in trade agreements concluded in the past by Asian economies and the United States. Petri et al. (2012) developed a database of trade agreements and assigned scores to the rigor of provisions in 21 issue areas commonly contained in them (Figure 1). The results show significant differences between agreements concluded, for example, by the United States and ASEAN. U.S. agreements tend to have much hi gher average scores on issues such as government procurement, intellectual property rights, investment, and competition. ASEAN agreements tend to have more limited provisions on average, but have higher scores on cooperation and collaborative dispute resolution. The results also show that, on average, intra-Asian accords have made more gradual and smaller cuts in higher initial tariffs, leaving larger barriers behind.

Since both tracks include diverse economies, they are likely to face many contentious issues. This is especially so for the TPP, which intends to limit exceptions and achieve high standards. Some controversial aspects of the TPP negotiations are highlighted in Box 3-1. In some cases these involve traditional conflicts between exporters and importers – for example, the United States is a major exporter of services, while many of its trade partners are primarily service importers. In other cases they involve issues such as labor and the environment, which are necessary to secure the passage of an agreement in the domestic politics of advanced economies.

Box 3-1: The TPP: A minefield of issues

Trade liberalization typically attracts passionate interest from individuals and groups that expect to gain the most, or fear to be hurt the most. Some issues have already attracted much controversy in many participating economies. A partial list of examples follows.

The intellectual property rights (IPR) chapter will address several contentious issues, with interest groups on both sides. Copyright-based industries – led by the movie industry in the United States – argue for provisions that go beyond the TRIPS provisions of the WTO in restricting illegal file sharing of movies, music and software. Such provisions are opposed by IPR importers and by interest groups and service providers that favor unregulated Internet access. Another important intellectual property rights battle involves the process that national health services use to put proprietary medicines on the list of those eligible for reimbursement.

The competition chapter is likely to adopt strict provisions to ensure “competitive neutrality” for state-owned enterprises (SOEs). The goal is to deny SOEs special access to capital, inputs, government procurement markets, and regulatory influence. Economies with largely private-sector economies support these provisions, but economies like Vietnam with a large state-owned enterprise sector face significant adjustments. Transparency requirements will also be difficult for some economies with sovereign wealth funds.

The service trade chapter is bound to be important in the TPP, with normally generous access, except for a limited number of sectors identified in a “negative list.” Economies with highly protected service industries or where service industries are in an “infant industry” stage will seek to expand this negative list. In Japan, for example, opposition to TPP service liberalization has already emerged from the Japan Medical Association, which opposes allowing for-profit companies into health service and insurance markets. Yet given Japan’s aging population, this is a potentially attractive market to other TPP economies.

The investment chapter is likely to include provisions that permit foreign investors to use UN or World Bank arbitration if they believe that government regulations resulted in the expropriation of their property. Such “investor-state” arbitration provisions have been included in hundreds of bilateral investment agreements (BITs) and the ASEAN Comprehensive Investment Agreement, but are opposed by Australia. One solution may be to exclude public health regulations, such as tobacco packaging, from arbitration.

Economies also have narrow but highly politicized “defensive issues.” Japan’s agricultural tariff quotas have strong support from its Association of Agricultural Cooperatives. Canada’s TPP debate is dominated by “supply management” in the dairy and poultry industries, where Canada imposes tariffs as high as 250 percent. The United States has long had restrictive sugar quotas.

Some economies have high priority “offensive issues.” Vietnam wants the rules of origin in textiles and apparel to be more liberal than the “yarn forward” rule, which would deny preferences to garments produced from imported fabrics and yarn. The United States is eager to liberalize financial services. New Zealand wants free trade in dairy products. Finally, issues such as labor rights and environmental rules have strong support from NGOs and labor unions.

Many of these issues will be difficult to resolve and, given intense political pressures, will require final negotiating decisions and strong support in the ratification process from the political leadership in each economy.

The PECC survey of opinion leaders also asked them to identify priorities for different trade issues (Chapter 2, Figure 11). The survey covered issues similar to those listed in Figure 1 and distinguished between responses from developed and emerging economies. The differences among the priorities of respondents from developed and emerging economies are similar to those revealed by the scores of past agreements in Figure 1. For example, developed economy respondents assign a higher priority to intellectual property, services market access, and investment access than their colleagues in emerging market economies. In turn, emerging market respondents assign a higher priority to goods market access (for manufacturing and agriculture), to cooperation and the movement of persons.

Interestingly, both groups of respondents see “new issues” as important. For example, the transparency of regulations is rated as a high priority by 43 percent of developed economy respondents (the highest among all issues) and by 40 percent of emerging-market respondents. Investment access, services market access and regulatory coherence are also seen as important by both groups. New issues generally have higher priority than “old issues” such as market access in goods and product standards. They are also given a higher priority than labor, cooperation, and the movement of persons. In other words, while developed and emerging-market respondents differ somewhat on specific issues, they agree generally on the importance of the behind-the-border issues prioritized by the TPP.

The Asian and Trans-Pacific tracks are interdependent and dynamic. Each influences the other by demonstrating faster progress, attracting more members, or adopting “better” provisions. They compete for acceptance and legitimacy in the international policy community. The two tracks already appear to be stimulating mutual progress. For example, some see the TPP as a response to Asian track agreements that have excluded the United States. (Seven of the eight partners as of 2011 had an FTA with China, and the eighth – Australia – was in the process of negotiating an agreement.) In turn, the TPP has led to more vigorous efforts on negotiations among China, Japan and Korea. The ASEAN++ initiative is still another move in this multi-player game.

Nevertheless, some observers see the tracks as potentially harmful. One set of concerns has focused on the impact of the tracks on other integration processes, notably ASEAN’s efforts to build a single market. As Box 3-2 demonstrates, various current trends – including bilateral FTAs as well as the Asian and TPP tracks – pose challenges to ASEAN centrality and the coherence of the ASEAN community. But it also appears that adverse side effects could be managed with thoughtful policy responses.

Box 3-2: Is ASEAN Centrality at Risk?

Some observers have expressed concern that the Asian and TPP track negotiations may undermine the central and effective role ASEAN has played in regional integration.

First, the active participation of ASEAN member economies in bilateral FTAs with partners outside the region raises the possibility of the weakened centrality, and even solidarity, of ASEAN. Such agreements could generate stronger linkages between some ASEAN members and non-members than now exist within ASEAN itself. However, ASEAN’s stepped-up efforts to build the ASEAN Economic Community (AEC) by 2015 lessens this concern, since member economies have acknowledged the need to build “one community, one destiny,” as emphasized at all ASEAN Summits since 2010. This vision is now backed up by commitments to institutionalize regional integration through the approval and enforcement of ASEAN Charter and ASEAN Blueprint.

Second, China, Japan and Korea (CJK) have recently agreed to negotiate an FTA among themselves, starting by the end of 2012. A significant deal among these economies could affect ASEAN negatively. Ex ante impact assessments suggest that a CJK FTA may produce “preference erosion” losses for ASEAN, since China and ASEAN compete in exporting products to Japanese and Korean markets. At the same time, China, Japan and Korea have expressed support for the centrality of ASEAN. The CJK FTA may constitute a necessary first step in easing tensions inherited from history, but it is not intended to become an alternative to ASEAN-centered integration (Singh 2012). Indeed, some type of CJK agreement is an essential part of any roadmap for integration that ultimately leads to an East Asia FTA.

Third, the TPP agreement could also undermine ASEAN centrality. The TPP currently involves only some, but not all, ASEAN members, raising the concern that members will strengthen linkages outside ASEAN rather than within it. Also, the TPP does not currently include China, the hub of global production networks that often involve ASEAN suppliers. By complicating relations between China and the US, the TPP could place ASEAN economies into the difficult position of juggling relations with these partners. At the same time, ASEAN is interested in new issues addressed by the TPP including, for example, the facilitation of merchandise and services trade, standard conformance, customs harmonization and investment facilitation. Moreover, the benefits of the TPP (as discussed in the text) could attract other ASEAN economies into the TPP. In that process, ASEAN may even assume a role within the TPP itself.

While current FTA trends raise questions about ASEAN’s future centrality, they also suggest possibilities for ensuring that ASEAN centrality is sustained and achieves its purpose – bringing about deeper integration within ASEAN and promoting broader groupings that enhance regional cooperation and economic welfare. Clearly, the preservation of ASEAN centrality will not be automatic. ASEAN can retain a pivotal role by strengthening intra-ASEAN integration and connectivity. If ASEAN takes bold steps to realize the AEC and to reduce intra-regional development gaps, it will increase its economic clout and collective voice in broader dialogues. Further, ASEAN could take steps to blend its vision for an ASEAN community into an East Asia community, for example, by pursuing an Initiative for East Asia Integration (Vo and Nguyen 2010). ASEAN’s involvement in such broad integration efforts – as a group and as individual economies – can be consistent with its overarching vision of open regionalism.

Potentially more serious may be tensions between China and the United States that result from their participation in the different tracks. Some observers have resorted to cold-war terms such as “encirclement” and “containment” to describe these interactions, even calling the TPP “economic warfare within the Asia Pacific region” (Rowley 2011). Critics of Asia-only agreements in the United States, in turn, have warned that China is attempting to squeeze the U.S. out of Asian markets in order to establish hegemony in Asia (Friedberg 2011). These viewpoints are far too extreme, but they feed on each other and damage the environment for cooperation. The Chinese and American economies are highly interdependent, and have much too much to gain from cooperation to view their relationships in such apocalyptic terms. Thus, even if the tracks remain separate for now, it is essential for Chinese and U.S. analysts and officials to focus on tangible progress toward region-wide integration. China and the United States are but single players in the two FTA tracks, but they have large stakes in an integrated Asia-Pacific economy.

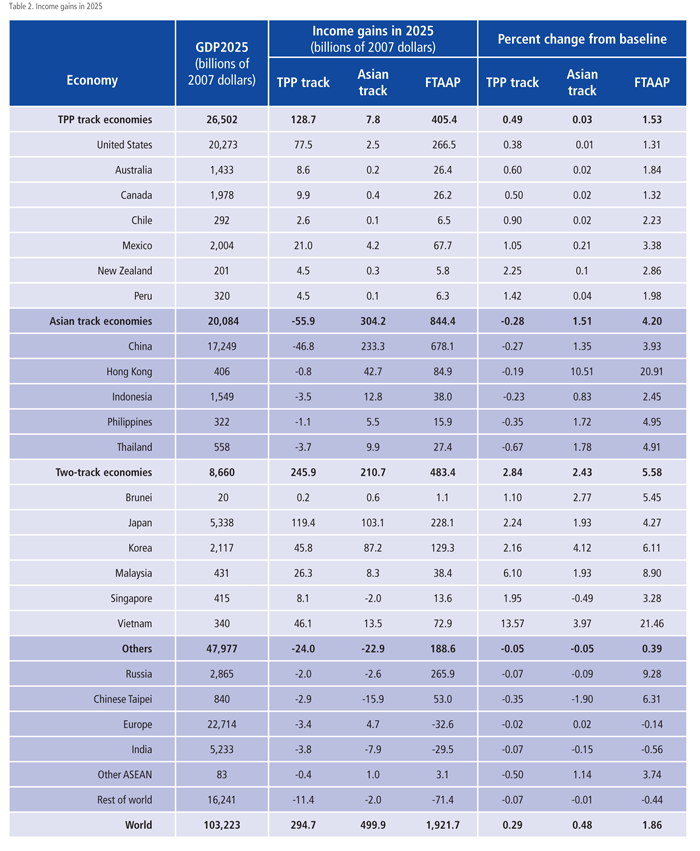

Economic Effects

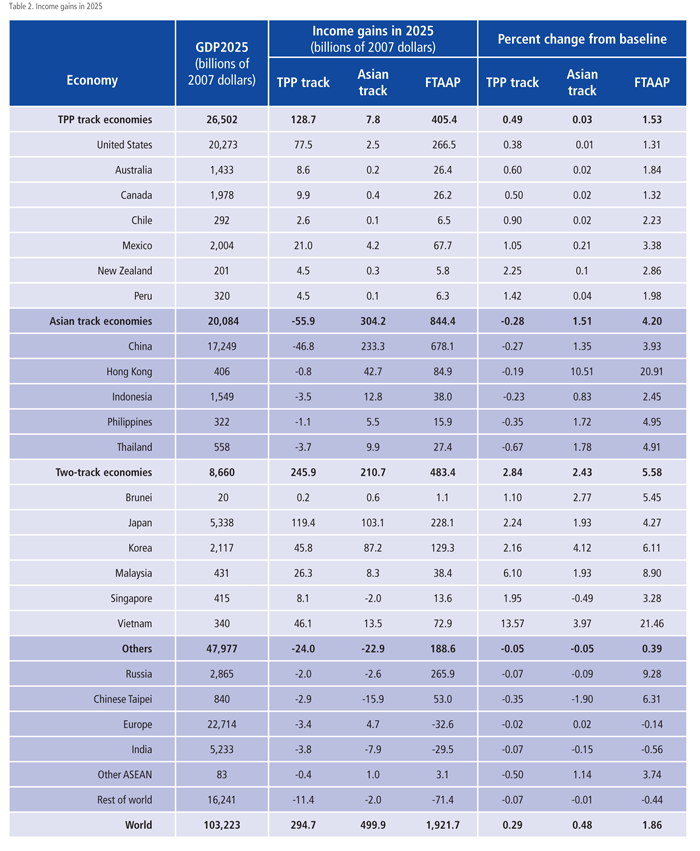

Estimates of the effects of the tracks have been developed by Petri, Plummer and Zhai (2012). The study defines the Asian track as an ASEAN+3 agreement and the TPP track as a 13-member grouping that includes the current 11 negotiating partners plus Japan and Korea. The income gains associated with full, regionwide liberalization are estimated at $1.9 trillion, or nearly 2 percent of world GDP in 2025. Similarly large effects are estimated for international trade, with the FTAAP increasing world exports by $3.4 trillion, or by 12 percent.

Interestingly, the study estimates total benefits on the Asian track to be larger than on the TPP track. One reason is that the economies participating in the Asian track have higher average barriers than those in the TPP track. The other is that much TPP trade is already covered by high quality trade agreements – for example, NAFTA, the P4, the AEC, and numerous bilateral agreements. Of course, for many economies the Asian and TPP tracks are not alternatives, and for some, like Japan, Korea and Vietnam, substantial benefits can be derived from both.

The study finds that Asia-Pacific agreements represent a Doha-scale project. The region accounts for only part of world trade, but it could achieve larger benefits if it implements deeper liberalization, as assumed in the Asian and TPP track scenarios. Furthermore, the results show that the benefits would increase with the scale and ambition of the integration project: for example, the FTAAP would generate more than twice the benefits that the Asian and TPP tracks could deliver together. Also, the benefits would be considerably larger if the more rigorous TPP template were used in the FTAAP instead of the Asian template. Importantly, an overwhelming proportion of the gains associated with the two tracks and the FTAAP would be derived from trade creation – deeper integration made possible by reduced barriers – rather than from trade diversion, or gains achieved at the expense of third parties.

The results also suggest a complex, multiple-move “game.” The early stages of this game are likely to be driven by preferential access to the markets of the United States and China. Smaller economies – Vietnam, Malaysia and Peru on the TPP track, and Korea and the ASEAN economies on the Asian track – stand to benefit the most. However, China and the United States are likely to participate in these early stages in order to strengthen their own bargaining positions in the subsequent stages of regional integration.

In the middle stages of the game the agreements would widen – to ASEAN+3 on the Asian track, and to a 13-member grouping on the TPP track – and integration would encompass several other large economies on each track. Economies that join both tracks would benefit the most – for example, in our scenarios Brunei, Japan, Korea, Malaysia, Singapore and Vietnam are all expected to do so. (Indonesia, the Philippines, and Thailand might also, eventually.)

In the final stage, China and the United States would be left among a few economies without preferential access to both of their large markets. For them, the grand prize would be a consolidated agreement – the FTAAP would offer China 2.9 times the benefits of the Asian track alone and the United States 3.4 times the benefits of the TPP track alone. Reaching a consolidated agreement will be hopefully easier in the future, when deeper integration and wider networks of agreements connect the region. Much will still depend on politics, but the economic benefits of integration will be compelling.

Note: The groups reported in the table reflect assumptions used in the simulations. TPP-track economies are those that were assumed to participate only in Trans-Pacific-track agreements. Asia-track economies were those assumed to participate only in Asia-track agreements, and Two-Track economies are assumed to participate in both agreements. The FTAAP was assumed to include all APEC economies. Source: Petri, Plummer and Zhai (2012).

Policy Implications

The Asian and TPP negotiating tracks appear to be gaining momentum and promise substantial, widely distributed benefits. The gains will be particularly large if the tracks proceed to regionwide integration and use a high quality template. Still, there are risks that the tracks will fail or head off in irreconcilable directions. Leaders and negotiators have great responsibility to balance the immediate pressures from constituents against the long-term objective of wider and deeper integration.

Several policy implications emerge. First, there is much to be said for early, vigorous progress on both tracks. After a gap of nearly two decades, the world trading system would get a much needed boost from new, large high quality trade agreements. The TPP negotiation appears to be especially close to conclusion; although controversial issues remain (and will not be settled before the U.S. elections in November), its 13 completed rounds of negotiations have brought it close to delivering real results.

Second, in order to lead to a region-wide agreement, the negotiations will have to reconcile high standards with the capacities and needs of diverse economies. One operational goal might be to limit agreements to provisions that “lead by a decade” – that is, to standards that are high, but no higher than could be accepted by a reform-minded economy in 10 years. Another goal should be to include innovative provisions for cooperation to help reduce development gaps. Key areas for cooperation include improvement of economic institutions, upgrading of human resource quality, and the promotion of technology transfer.

Third, the Trans-Pacific and Asian tracks of negotiations should be connected by a new, high-level dialogue. Such a dialogue could encourage substantive overlap between the tracks, ensure their compatibility with the end goal of region-wide free trade, and reduce political frictions. Formats might include technical exchanges, discussions among senior officials, or an Eminent Persons Group. The dialogue could be convened by APEC, ASEAN, the WTO or an ad hoc group of economies involved in both tracks. Various institutions, including APEC and the WTO, could provide technical support. This dialogue could help to shape the 21st century global trading system.

Fourth, since the tracks might lead to friction between the China and the United States in their initial stages, attention also needs to focus on a third track – direct cooperation between them. They have the most to gain from a region-wide agreement and should strive gradually but systematically to narrow differences that might block that outcome. Other elements of cooperation could address joint initiatives to reduce development gaps and support ASEAN integration, jointly providing the public goods that facilitate deeper regional integration. The China-U.S. Strategic and Economic Dialogue (S&ED) offers a potential venue, and the political climate for such efforts will hopefully improve once both complete the 2012 leadership selection process.

An integrated Asia-Pacific economy and good rules for trade and investment are important for the region and the world. The Trans- Pacific and Asian tracks, and especially the TPP, represent pathways to such integration. There are risks associated with these strategies, but there is also reason to hope that their coherent progress will help to realize APEC’s Bogor Goals of free trade and investment in the Asia-Pacific, and perhaps export its template to the world.

References

Asian Policy Forum (2010). “Policy Recommendations to Secure Balanced and Sustainable Growth in Asia.” Tokyo: ADBI. October.

Friedberg, Aaron (2011). “Hegemony with Chinese Characteristics.” The National Interest. July-August.

Singh, B. (2012). “Trilateral Northeast Asia FTA: Pragmatic Regionalism.” RSIS No. 098/2012. 11 June.

Petri, P.A. and M.G. Plummer (2012). “The Trans-Pacific Partnership and Asia Pacific Integration: Policy Implications.” Policy Brief 12-16. Washington: Peterson Institute for International Economics.

Petri, P.A., M.G. Plummer and Fan Zhai (2012). The Trans-Pacific Partnership and Asia Pacific Integration: A Quantitative Assessment. East-West Center and Peterson Institute for International Economics Policy Analysis. Washington: Peterson Institute for International Economics.Forthcoming.

Rowley, Anthony (2011). “What the TPP is really about.” The Business Times (Singapore). 2 February.

Vo, T.T., and A.D. Nguyen (2010). “Development Cooperation in East Asia.” Paper presented at the conference on East Asia Economic Integration in the Wake of Global Financial Crisis, Seoul, Korea. 7 July.

<< Previous

Next >>