Section 4 - Asian investments in North American oil and gas industry

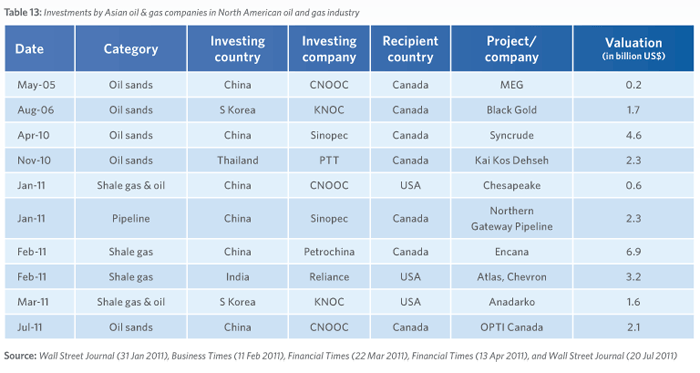

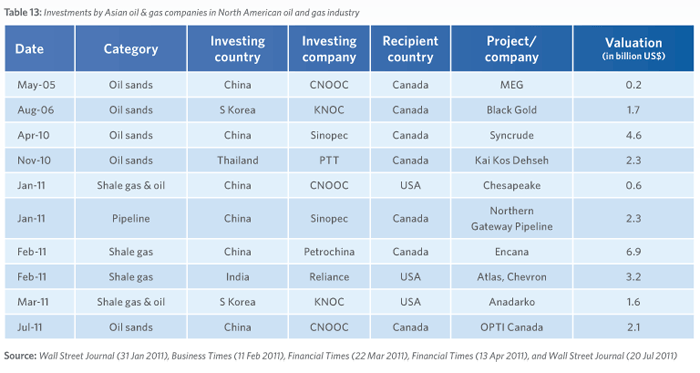

In addition to growing interest in transpacific energy exports from North America to Asia, the past few years have also featured a trend of increasing capital and equity investments by Asian state-owned oil & gas companies in the North American oil and gas industry. Table 13 below summarizes some of the key recent investments that have been made. Almost all of the investments have been in unconventional oil and gas resources.

Most of these investments are likely motivated by straightforward profit-maximizing interests that take into account the growth prospects of shale gas and oil, as well as oil sands. In the case of oil sands, rising crude oil prices imply greater profits from those investments. Investments in shale gas are harder to defend from a profit-maximizing perspective, given the low price of natural gas in North America, if there is no intention of exporting the gas to higher paying markets.

It is likely, therefore, that some of the Asian investments in unconventional gas are motivated by broader objectives. One source of motivation could be the desire to acquire experience and technical know-how to develop similar unconventional gas fields in home economies. China, for example, is known to have substantial shale gas reserves, even though these are in remote areas that do not have access to the vast amounts of water that are needed for hydraulic fracking.

Furthermore, some of the investments appear to be tailored towards securing Asian oil and gas imports. Sinopec’s investment in the Northern Gateway Pipeline (which, if completed, would allow the transport of heavy oil to the west cost for onward shipment to Asia) appears to be motivated by a desire to secure a new import source for oil. In the same way, the recent initiative by Petronas to set up an LNG export terminal in Canada (see Table 10 above) is likely motivated by a similar desire to for access to a secure long-term energy source.

Hence there are important synergies between the North American drive to export LNG to Asia, and the Asian drive to invest in the North American oil and gas industry. Both these trends point to an important conclusion - North America and Asia are becoming increasingly interdependent in energy terms, with each having a stake in the other’s energy sector. North American LNG exports to Asia could mean that the Asian and North American gas markets will no longer be disconnected, with prices in one market affecting prices in the other. By the same token, Asian investments in North American unconventional oil and gas industry will mean that both Asia and North America will have a stake in how the unconventional gas boom in North America plays out.

<< Previous