Section 1: The Asia Pacific Economic Outlook

Growth will slow in 2007 - as expected

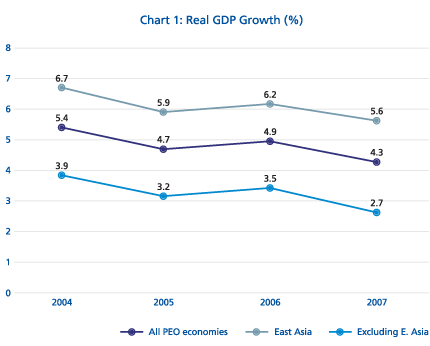

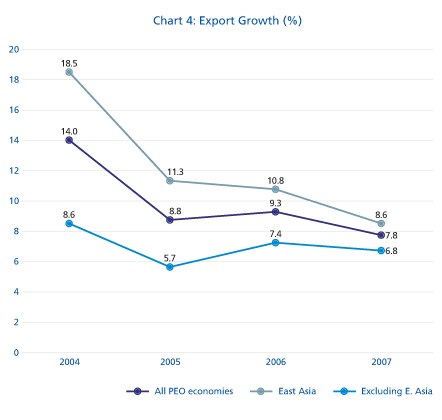

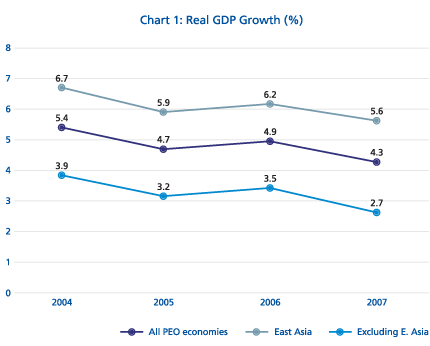

The PECC Pacific Economic Outlook team believes that following a year of upside surprises in the Asia Pacific growth outlook for 2006, the forecast for 2007 is for a modest slowdown across the region. Our team's weighted average real GDP growth for 2006 is projected at 5.0 percent, slowing to 4.3 percent in 2007. Most of this growth will be in East Asia. Still East Asia will see a decline in real GDP growth from 6.2 percent in 2006 to 5.8 percent in 2007, compared to the rest of the region which is forecast to grow by 3.5 percent in 2006 and by 2.7 percent in 2007.

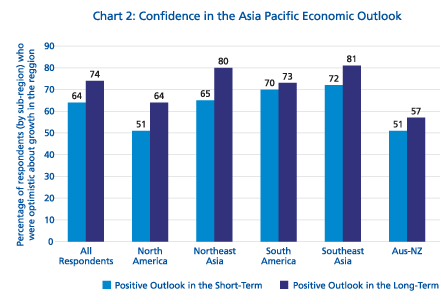

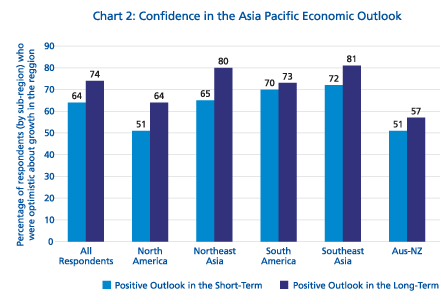

The survey results on the economic outiook are generally consistent with PECC's forecasting panel. Respondents are less bullish on the 1-2 year outlook than on a 3-5 year horizon. Sixty-four percent of respondents feel that the Asia Pacific economic oudook will improve somewhat in the next one to two years, compared to 74 percent who are positive about the oudook in three to five years.

A slowdown in 2007 has been widely anticipated, and is largely due to faltering demand in the United States and the effect of monetary tightening around the world. Despite lower growth across the region, the economic oudook remains healthy and Asia will remain the most dynamic growth region in the global economy. However, there are a number of risks that could precipitate a more severe downturn.

Trans-Pacific Imbalances to Improve

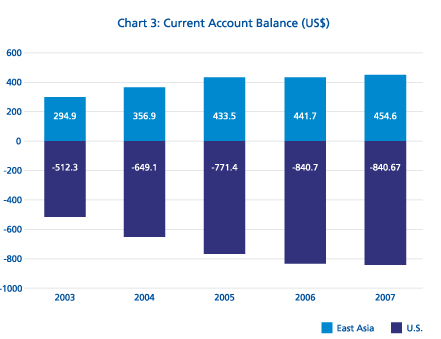

The region continues to be characterized by an acute imbalance in trade and financial flows, with the U.S. current account deficit on the one side, and current account surpluses in many East Asian economies on the other. This imbalance remains a risk, but there are increasing and positive signs that it is no longer likely to grow, and in fact, is beginning to be reduced, at least in percentage of GDP terms.

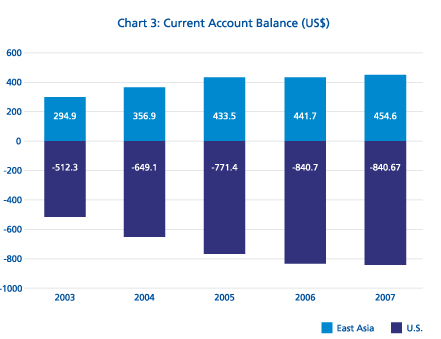

Deficits at a Peak

The U.S. current account deficit is expected to peak in 2006 at US$840 billion and remain at roughly the same level in 2007. As a share of GDP, however, the U.S. deficit will finally show improvement in 2007, falling to around 6.0 percent of GDP. East Asia's collective surplus is expected to be around US$455 billion in 2007, more or less the same as the 2006 level.China's current account balance will rise to US$171 billion in 2006 before falling back to around US$165 billion in 2007. As a share of GDP, the surplus reached a peak of 7.0 percent in 2005 and is expected to fall to about 5.0 percent of GDP in 2007.

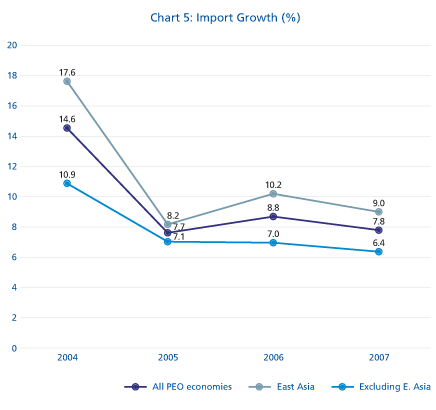

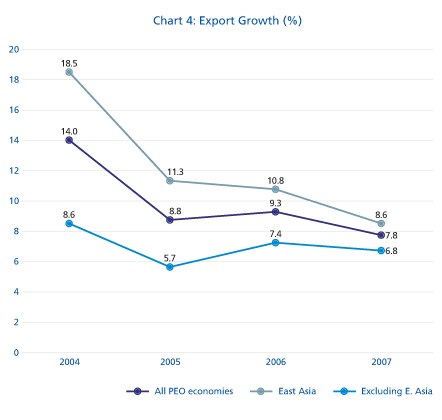

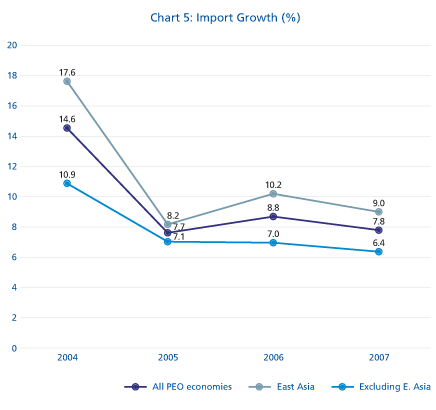

In 2006 and 2007, import growth in East Asia is expected to exceed export growth, in sharp contrast to the very low rate of import growth in 2005. This forecast assumes steady appreciation of the yuan, from an average of 8.2 to the U.S. dollar in 2005 to 7.7 by 2007. Thus while we cannot discount a hard landing as a result of trade and current account imbalances, the direction has begun to turn. This has come less through government policy action than through natural market forces.

U.S. Domestic Demand to Weaken

Turning to the biggest Asia Pacific economies, all enjoy relatively strong growth, but there remain significant down¬side risks. Whereas a majority of respondents believe that the Chinese, Japanese, and Indian economies will improve in the short and medium-term, only 19 percent are optimistic about the U. S. economy over a 1-2 year time frame and 28 percent over a 3-5 year outlook. Pessimism about the U.S. economy also dominates the 3-5 year outlook, even though the gap between pessimists and optimists is much smaller.

Lower growth in the United States - 2.3 percent in 2007 as against 3.3 percent in 2006 - reflects significantly weaker domestic demand. This has been foreshadowed by two key indicators: sales of light vehicles, which fell by 1 million last year, and housing starts, which are down from 2.1 million in the second quarter of 2005 to 1.9 million a year later.

Higher energy prices and increases in short-term interest rates, reflected in mortgage rates, are having an enormous impact on the perceived wealth of American consumers, who have been one of the principal drivers of Asia Pacific and world economic growth.

Another terrorist attack, continued oil price volatility, inflation pressures rising from non-energy crude materials used in construction and manufacturing, and unruly adjustment in currency markets are all factors that could bring the U.S. rate even lower.

China Still Soaring

The other driver of regional economic growth has been the rapid expansion of China. We expect the Chinese economy to grow at double digit rates in 2006 and 2007. Chinese growth continues to be led by fixed asset investment, which is expanding at an annual rate of around 28 percent.

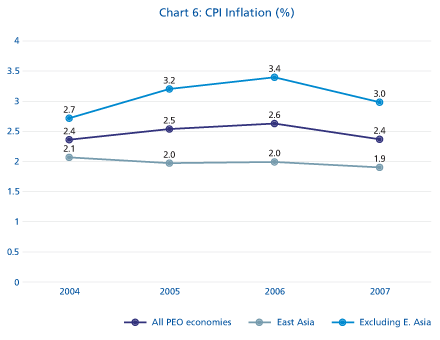

Measures put in place in the summer have failed to bring this down to a more moderate pace, raising concerns about overheating, the over-expansion of capacity, and misallocation of resources. Consumer expenditures have been strong in 2006, buoyed by solid income growth. In the first half of the year, total retail sales of consumer goods expanded by 12.4 percent in real terms, an increase of 0.4 percentage points over the previous year. Inflation remains modest, despite pressures on some materials.

downside risks include weaknesses in the financial system and the potential impacts on China's trade of a slowdown in the U.S. economy or increased protectionism

Aside from over-heating, other downside risks include weaknesses in the financial system and the potential impacts on China's overseas trade of a slowdown in the U.S. economy or increased protectionism in U.S. and other foreign markets. Sixty-four percent of those surveyed by PECC believe the economic oudook for China will be positive in the short term, with another 72 percent who are positive about the three to five year outlook. Whereas respondents from Southeast and Northeast Asia are the most upbeat about China's prospects, North American and South Pacific respondents were more circumspect.

Japanese Economy on Track

The Japanese economy is on track to expand by 2.7 percent in 2006, more or less in line with our previous forecasts. Even though real GDP growth during April-June 2006 was only 1.3 percent (annualized), nominal GDP growth in that quarter outpaced real growth for the first time in three years. Indeed, respondents to our survey are also optimistic about a continuation of the current economic recovery in Japan, with a majority of respondents agreeing that the outlook is positive in the short and medium-term.

The GDP deflator inched up 0.1 percent in April-June, marking the first departure from deflation since 2003. Other data suggesting the end of a prolonged deflationary period include a rise in unit labor costs for the first time in four quarters. We expect upward price pressures to continue, leading to a rise in CPI of 0.8 percent for 2006 as a whole and by the same amount again in 2007. As the demand-supply gap narrows, the corporate sector will be able increasingly to pass on cost increases. Corporate profits will remain at a high level, even though the pace of growth is expected to slow.

Business sentiment continues to be upbeat, which should translate into stronger investment. Non-residential investment in 2006 is expected to grow by a robust 9-4 percent in real terms, exceeding the previous year's growth of 7.7 percent.

Private Consumption to Surge

The outlook for Japan's real GDP growth in 2007 has been revised sharply upwards from 1.6 percent to 2.2 percent because of continued strong private consumption. Private domestic demand alone is expected to contribute 1.9 percentage points to GDP growth in 2007. On the other hand, exports will slow and non-residential investment will also lose steam.

The major risks to the Japan forecast are threefold: Higher oil prices, hard-landing of the U.S. economy, and a possible premature tightening of monetary policy by the Bank of Japan,

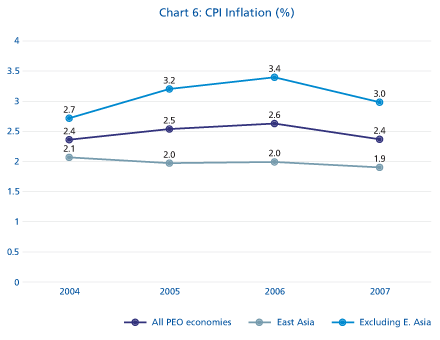

Modest Slowing Elsewhere

Other Asian economies, as well as Australia and New Zealand, will also, in general, see a slowing of real GDP growth in 2007. Inflation has been exacerbated by high energy prices, but remains muted throughout the region. The weighted average CPI for the East Asian economies is expected to fall slightly, from 2 percent in 2006 to 1.9 percent in 2007. Latin American member economies of PECC will see a slowdown in real GDP growth from 4.5 percent in 2006 to 3.9 percent in 2007. Price pressures are more acute in Latin America than in other parts of the Asia Pacific region, with CPI expected to rise sharply from an average of 3.4 percent in 2006 to 4.3 percent in 2007.

<< Previous

Next >>