Growth in the Asia-Pacific region rebounded in 2009-10 but risks in the 2011 outlook have increased with Europe’s sovereign debt problems, weak US growth and rising international tensions over external imbalances and exchange rate regimes. Urgent short-term measures are needed to take up the slack and head off protectionism. The most important outcome of the G20 summit in Seoul will be evidence of leaders’ commitment to macroeconomic and structural measures to assure balanced and sustained medium-term growth. As the world’s most dynamic region, the Asia-Pacific economies have a particularly important role to play and much at stake.

To achieve sustainable long-term growth the extraordinary fiscal interventions in the crisis must be wound down, global growth must be rebalanced and structural policies adopted that raise the region’s growth potential. A strategy for restructuring and rebalancing was put forward in 2009 in a task force report commissioned by the Pacific Economic Cooperation Council which identified policy priorities for economies in Asia-Pacific, acting on their own and collectively, to sustain growth beyond the crisis. This chapter builds on that report.

In 2010 collective action has been high on the agenda. Economies in the Asia-Pacific hosted two G20 leaders’ summits, at Toronto in June and Seoul in November. At Toronto as growth rebounded, leaders agreed to a macroeconomic exit strategy, pledging to cut fiscal deficits in half by 2013 and to stabilize or reduce debt-to-GDP ratios by 2016. The G20 Mutual Assessment Process supported by the international institutions examined the global consequences of economies’ domestic policies and identified opportunities for their governments to do things differently – and to do different things — to contribute to a more positive global outcome. If growth continues to lag and external imbalances are not addressed the risks of trade protectionism will rise.

At the Seoul G20, Asia will be in the spotlight. Despite the resumption of robust growth in the Asian economies, its composition still needs to shift from reliance on external demand to greater reliance on domestic demand. Such a shift will help to take up the slack caused by the slow recovery in the largest advanced economies. But, as pointed out by the 2009 task force, sustainable growth depends on an agenda of challenging policy changes: structural and institutional changes to support global rebalancing by relying more on domestic demand, financial regulatory reforms and the successful conclusion of the global trade talks. Progress is reported in the next section. The final section suggests the priorities for action in 2011, both by major economies and collectively in APEC and Asia’s main regional institutions.

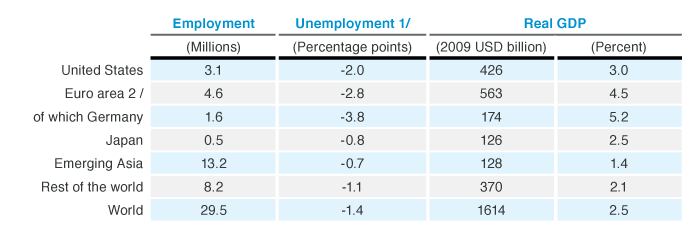

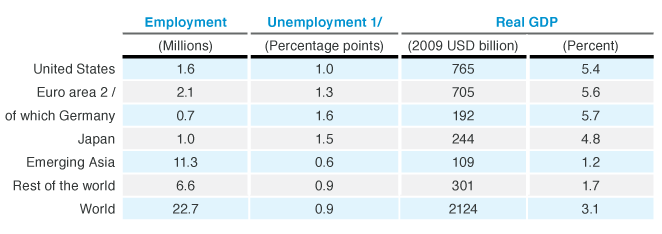

Progress Towards Strong, Sustainable and Balanced GrowthThe G20’s framework for strong, sustainable and balanced growth relied on fiscal and monetary stimulus, which would be wound down with the resumption of self-sustaining private sector growth. In 2010 global growth has increased to an expected 4.8 percent average rate, but it is multi-speed (Figure 1). By IMF estimates, among the biggest economies China’s economy is expected to grow by 10.5 percent growth Japan at 2.8 percent and the United States at 2.6 percent. These rates are expected to moderate in 2011 to 4.2 percent as output returns to pre-crisis levels and productivity increases as jobs are not replaced. The Asia-Pacific region as a whole is expected to rebound to 4.4 percent growth this year.

Figure 1: Real GDP Growth, IMF October 2010

Macroeconomic Exit StrategiesThe first priority for governments and central banks in the advanced economies is to ensure that private sector growth is rebounding: that businesses are restocking inventories; hiring rather than firing; that labor market expansion is supporting household income growth and consumer spending which in turn is encouraging businesses to invest. The evidence is still muted and authorities are being cautious. If stimulus is withdrawn before sustainable growth is achieved, these economies could enter a renewed slump, even a deflationary spiral. Exit too late, however, and precious resources have been wasted and the seeds of future inflation sown. At the same time the large OECD economies have little room left for further fiscal stimulus because of large structural deficits and high levels of indebtedness: the IMF projects aggregate public indebtedness will be 110 percent of GDP in 2015.

In economies with large credit bubbles, interest rates are at historic lows and central bank balance sheets are in uncharted territory. While monetary policy should not be used to reduce the real burden of public indebtedness, central banks continue to rely on quantitative easing to provide stimulus.

The G20 leaders’ commitment to fiscal consolidation at Toronto helped to formalize the need for exit strategies in the advanced deficit economies. These need to be signaled well in advance to condition expectations. But such exit strategies should also be structured to anticipate longer-term requirements and to be ‘growth-friendly’. They should take account of longer-term imperatives such as demographic shifts; thus as fiscal stimulus is removed, primary balances should be improved to meet the challenges of aging populations (which implies both tax reforms and changes in entitlements). Governments should also shift public spending in the direction of investments that foster future growth, such as education, green infrastructure, physical infrastructure upgrading and the reduction of distortionary taxes. In surplus economies, shifts in spending are desirable to support households bearing the burdens of adjustments in product and labor markets in some cases and to support aging populations in others.

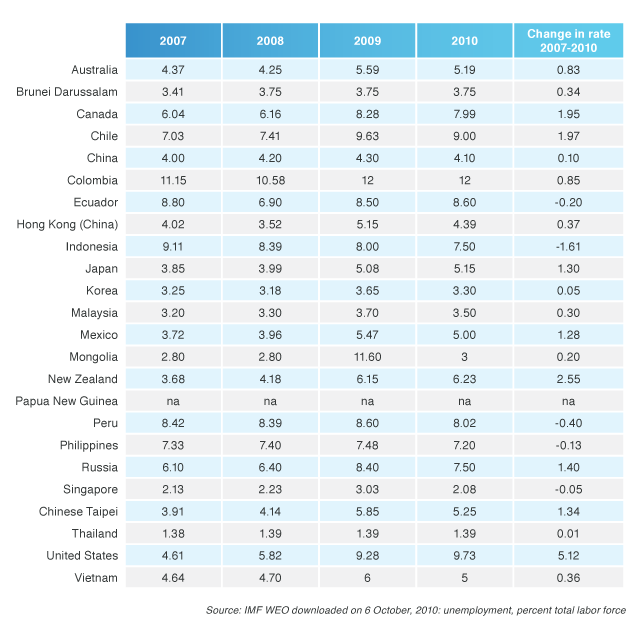

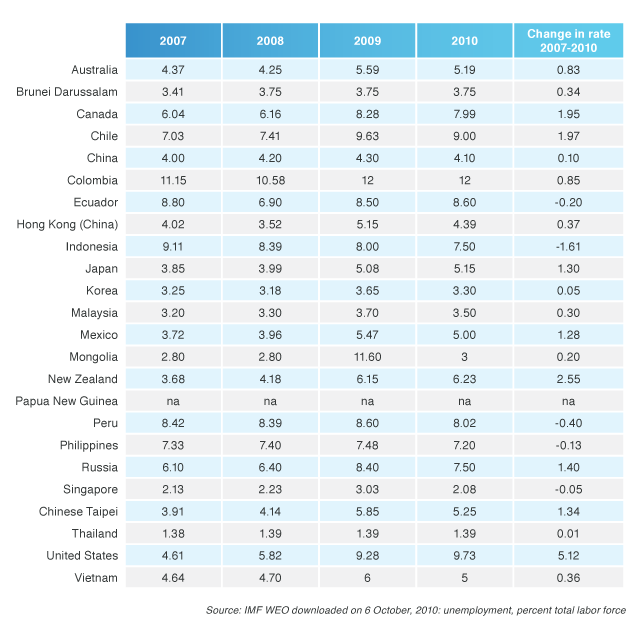

The exit strategies of the United States, China and Japan are of particular importance in the Asia-Pacific region. In the United States, there is debate over whether more stimulus is needed on one hand or fiscal austerity on the other. Stimulus proponents argue for more public spending to maintain demand in the absence of rising private demand, job growth, (Table 1) and fiscal problems of state governments. Proponents of austerity argue that such spending will increase public indebtedness, add to uncertainty about future taxes, continue to mask structural unemployment, and inhibit businesses’ investment and hiring decisions. Without a compromise, the United States lacks a credible medium-term fiscal consolidation plan. Prior to the Toronto summit President Obama publicly committed to reduce the fiscal deficit to 3 percent of GDP by 2015. But the administration’s own 2011 budget projected the deficit-to-GDP ratio will drop to 11 percent in 2010 (down from 13 percent in 2009) and decline to not more than 4 percent between 2015 and 2020 (whereas 2-3 percent is considered to be sustainable). Private sector forecasts have the deficit remaining above 5 percent of GDP in the next decade. These numbers are not sustainable.

The Administration’s proposals in the 2011 budget rely mostly on expenditure compression rather than on added revenues. The imminent expiration of Bush-era tax cuts, a major factor contributing to persistent deficits, is also the subject of heated debate. The economic reality is that achieving a sustainable fiscal position will require higher revenues raised in a ‘growth-friendly’ way, such as through tax reforms that shift the burden of taxes away from income and property towards consumption. Since no politician is willing in the current polarized political environment to advocate higher taxes, the bipartisan National Commission for Fiscal Responsibility and Reform, with all expenditure and revenue items on the table, is the most promising mechanism to provide objective analysis and expert advice.

Table 1: Unemployment Rates

China also carried out a strong fiscal stimulus program beginning in 2008. A surge in directed lending by the banking system magnified the impact of increased government spending. In 2009 China’s growth performance led the world; as signs of inflation appeared in late 2009 administrative measures were used to rein in bank lending to the property markets and local governments. By mid-2010 signs of slowing activity prompted some loosening of credit for infrastructure and alternative energy investment. Exchange rate management was also eased prior to the Toronto summit as the central bank abandoned the de facto peg to the US dollar and returned to the practice begun in July 2005 of managing the exchange rate relative to a basket of currencies.

Japan, the economy most affected by the collapse of net exports in 2009, experienced a robust rebound in 2010 with growth nearly 5 percent in the first quarter and expected to average 2.4 percent for the year. As the restoration of external demand fades and fiscal policies are tightened, however, growth is expected to slow in 2011.

While short-term macroeconomic exit and fiscal consolidation is not a particular priority in East Asian economies with prudent fiscal and monetary policies, the medium-term imperative of global rebalancing will depend their active participation in reducing reliance on export-led growth and depending more on domestic demand.

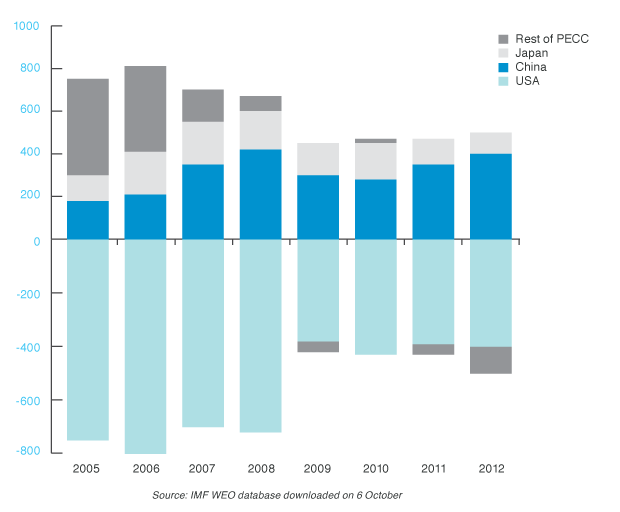

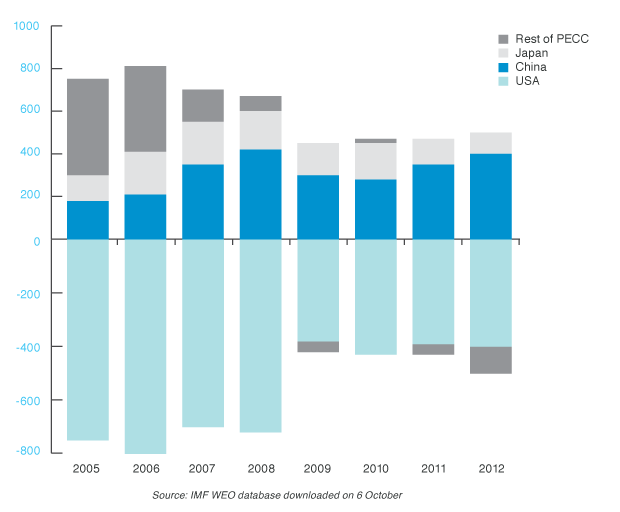

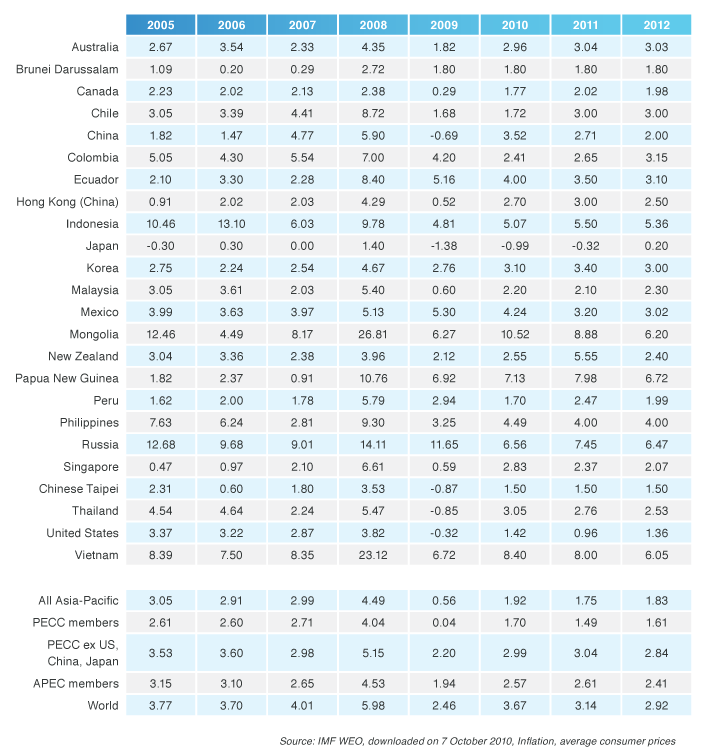

Addressing Global Imbalances The second priority, and more difficult, is to change the composition of aggregate demand as growth returns. Global current account imbalances peaked in 2006 but the IMF expects them to rise again, as surpluses rise in East Asia with the restoration of global trade and financing flows (top segment of each bar in Figure 2). To prevent their recurrence, economies with external surpluses should rely more on domestic demand and imports while those with external deficits should rely more on exports. Flexible exchange rates would help cushion the necessary adjustments.

Figure 2: Current Account Imbalances

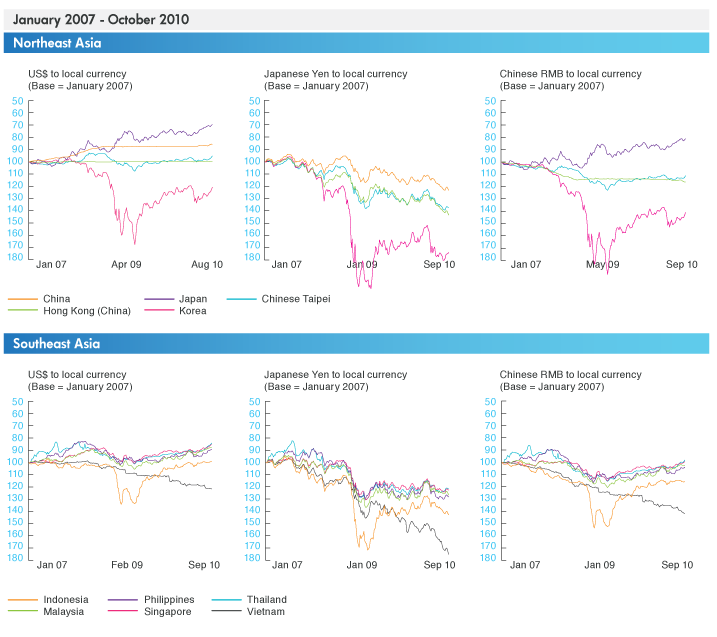

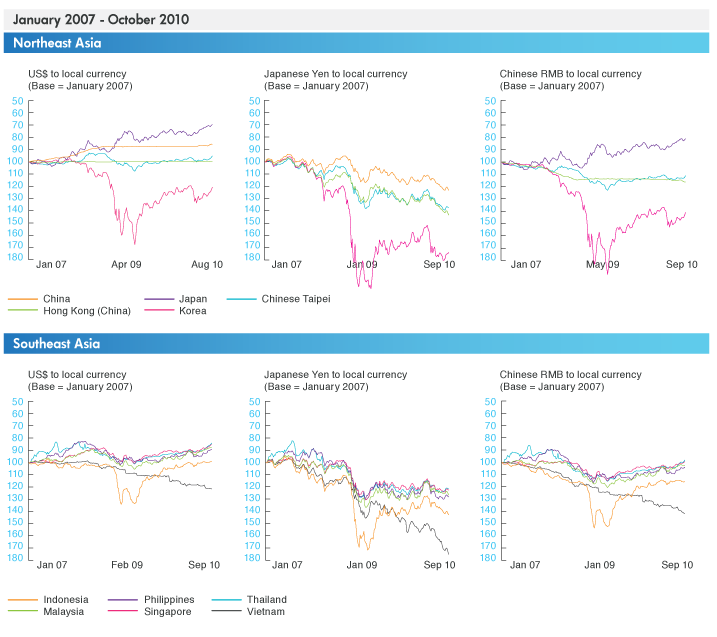

Rebalancing will be both a technical challenge and the G20’s biggest political challenge. Some surplus economies continue to resist flexible exchange rates, reflecting fears that real and nominal exchange rate volatility will undermine their export-led growth while doing little to address structural problems in either deficit or surplus economies. Few currencies in Northeast or Southeast Asia have shown much upward flexibility against the US dollar (Figure 3) with Korea showing a large depreciation. Movements in RMB exchange rates have largely mirrored those against the US dollar. Japan is the exception; yen appreciation is reflected in the sharp downward movements of other currencies against the yen.

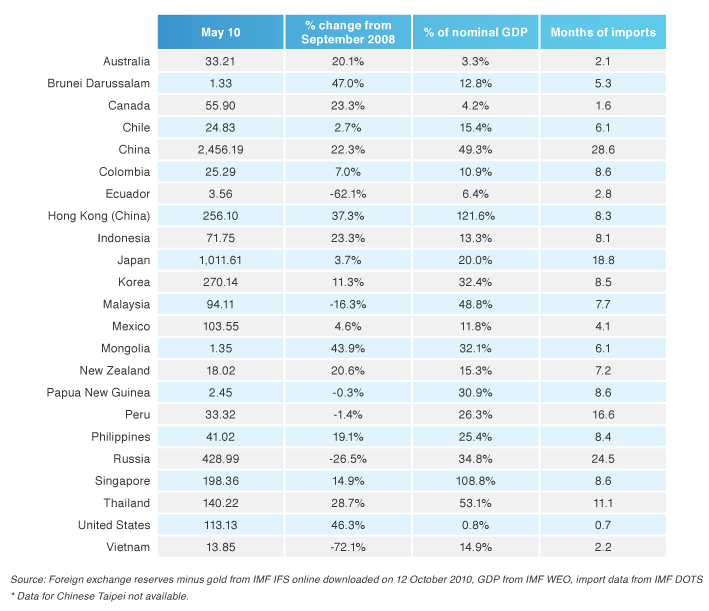

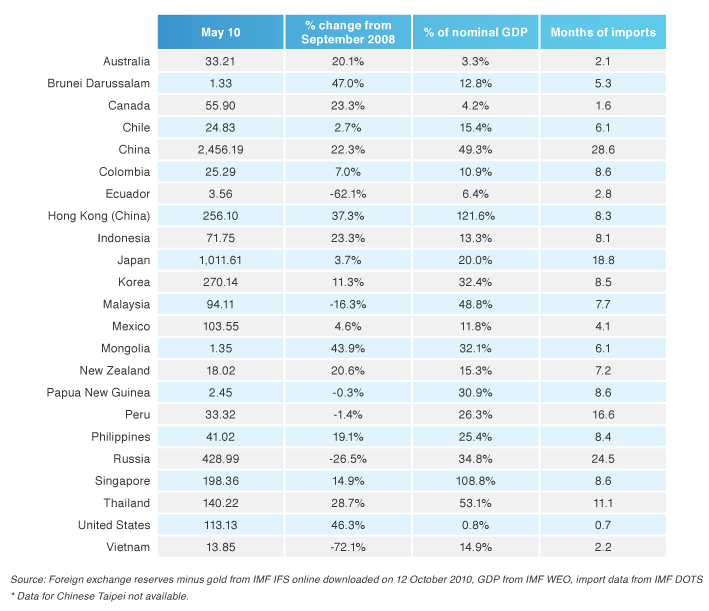

The buildup of foreign exchange reserves since 2008, which in China, Malaysia, Singapore and Thailand now amount to 50 percent or more of nominal GDP (Table 2), provides further indication of resistance to appreciation. Yet one of the lessons to draw from the market adjustments that reduced the imbalances in 2009 is that they could have been less disruptive with flexible exchange rates. In the absence of flexible exchange rates more of the burden of adjustment must be borne by structural policies that may not be popular at home as they impact consumer and trade interests vested in the unsustainable status quo. With the US consumer no longer the engine of growth it once was, surplus economies must make a determined effort to rebalance to take up the slack.

Figure 3: Asia-Pacific Exchange Rate Movements

Table 2: Foreign Exchange Reserves minus gold (US$ billion)

Table 2: Foreign Exchange Reserves minus gold (US$ billion)

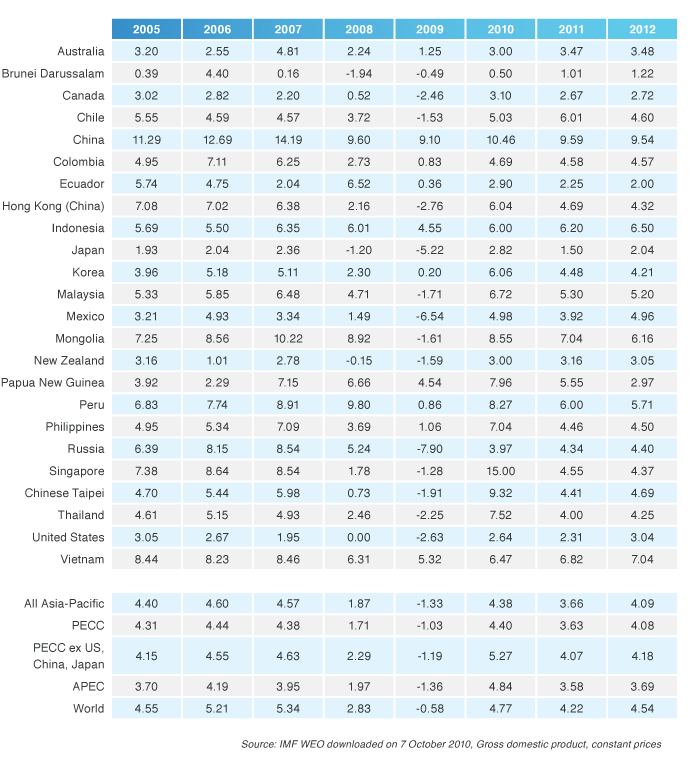

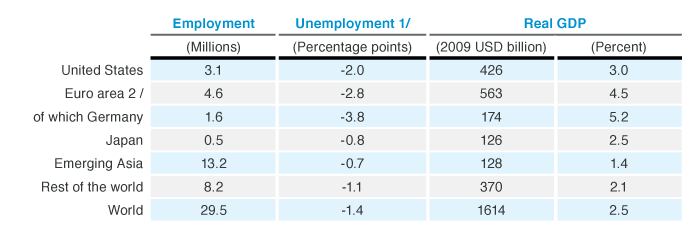

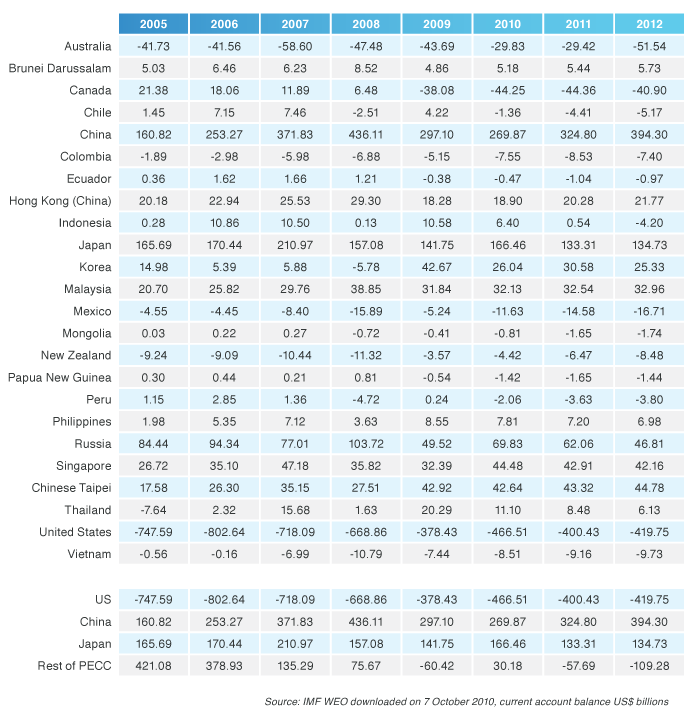

The IMF in cooperation with the OECD and other international organizations has shown the benefits of collective action to reduce imbalances and the risks of continuing the status quo. In preparation for the Toronto summit the IMF prepared a base line scenario of growth and output in 2014 based on member economies’ own forecasts and adjustment packages. These were then adjusted for consistency and subjected to alternative assumptions reflecting upside possibilities and downside risks. Significantly the model assumes exchange rate flexibility. The differences in outcomes under the two scenarios are startling. Collective action yields large benefits: world output would be higher by US$ 1.6 trillion and global growth over the next five years would be 2 1/2 percent higher than the baseline. Over 29 million jobs would be created globally, including 13.2 million in emerging Asia (Table 3A.).

Table 3A: Upside Scenario: Employment and Output Gains by region (IMF Mutual Assessment, June 2010) # Notes: 1/ Unemployment for emerging Asia and rest of the world is calculated using the respective output responses and assuming the maximum estimated unemployment response in the other regions.

# Notes: 1/ Unemployment for emerging Asia and rest of the world is calculated using the respective output responses and assuming the maximum estimated unemployment response in the other regions.

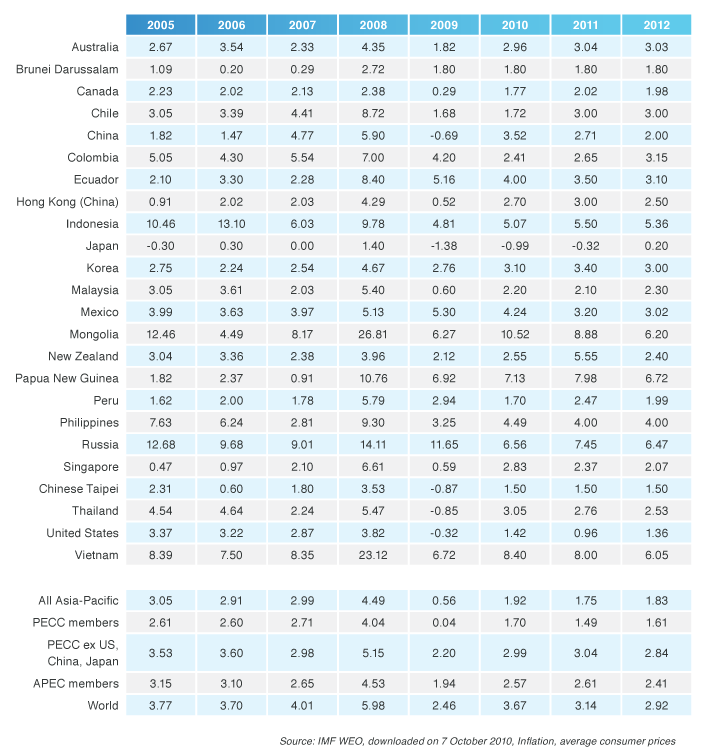

Table 3B: Downside Scenario: Employment and Output Losses

Risks in the downside scenario compared to the baseline (Table 3B) imply large losses in output and employment – 23 million jobs lost of which more than 11 million are in emerging Asia and a million in Japan — and poverty would increase by an estimated 60 million people. World output will be 3.1 percent lower and unemployment nearly 1 percent higher than the baseline.

Comparison of the downside and upside scenarios provides a dramatic estimate of the global benefits of collective action. Global output would be 5.6 percentage points higher with policy actions (comparing Tables 3A and 3B fourth columns, bottom lines) than if the risks were to materialize. Unemployment would decline rather than rise (even in emerging Asia unemployment rises in the downside scenario).

What are the key policy actions that account for the differences in these scenarios? Clearly growth-friendly fiscal consolidation in deficit economies is essential. Beyond that two kinds of structural reforms are included in the models: structural reforms that strengthen domestic demand (and compensate for lower US consumer demand) and structural reforms that enhance productive potential.

Strengthening domestic demand: Economies with external surpluses are assumed to take up some of the slack in global demand by strengthening domestic demand with such measures as strengthened social safety nets with pension and health insurance programs, enhanced physical infrastructure that reduces supply bottlenecks, reformed corporate governance and more-developed financial markets that can extend credit to small and mediumsized enterprises. Household demand is assumed to expand as wage rises are permitted, restrictions loosened on labor mobility and households provided with capital income-generating opportunities. The structure and timing of such reforms will depend on each economy’s economic circumstances and institutions, but the direction and urgency of the reforms is clear if longer-term sustainable growth is to be achieved.

The Mutual Assessment exercise found that raising public investment in emerging Asia by 2 percent of GDP over three years increases domestic demand relative to the base case through investment projects and stronger safety nets that provide targeted transfers to the poor. These expenditures are financed with higher deficits and higher consumption taxes.

Enhancing economic potential: Advanced economies with external deficits could take a number of measures that include reforming entitlement programs, product market reforms that encourage competition in network industries, professional services and retail distribution. The OECD estimates that even moving to ‘best practice’ product market regulation would raise productivity growth. Labor market reforms to increase the flexibility of labor markets, particularly in Europe, would also be growth-enhancing. Emerging market deficit economies could simplify product market regulation and increase the efficiency of the formal sectors to encourage more employment.

These changes would support more balanced growth through time. Current account deficits will decline as currencies depreciate, savings will rise in advanced deficit economies and external demand for their products will increase while in advanced surplus economies product and labor market reforms will enhance both investment and consumption. In emerging surplus economies, reduced precautionary saving and higher infrastructure spending will boost domestic demand and imports which, with currency appreciation, will help reduce current account surpluses.

Financial Regulatory Reforms Financial regulatory reform in the advanced economies at the epicenter of the crisis is the third priority. To achieve sustainable growth, financial institutions must also be willing to resume lending. A troublesome aspect of the recovery is the uncertainty around financial sector reforms, both because of pushback from powerful vested interests and the need to get the reforms right. In the troubled advanced economies the extraordinary support for the financial sector during the crisis has to be unwound and banks’ bad assets removed from their balance sheets. Risks of future instability also need to be reduced and ways found to tackle future financial crises without taxpayer support. Financial reform legislation along these lines has been adopted in the United States but global standards are still needed to prevent new regulatory differences that will affect cross-border capital flows. The Basel institutions have decided on new and safer minimum required standards for capital and liquidity that will be presented to leaders at the Seoul summit.

Safeguarding Trade Liberalization and Concluding the Doha Round The fourth priority is to safeguard trade liberalization despite the lack of global growth momentum. The IMF’s downside scenario paints the risks of renewed recession. Jobless growth and rising structural unemployment in the run up to US midterm elections risks renewed protectionism and political pressures to turn back globalization. Few governments have much fiscal room to maneuver in the face of still-high unemployment and rely instead on external demand. If both deficit and surplus economies pursue the same strategy the threats of protectionism will rise. The return of the US trade deficit in June 2010 to a size not seen since the crisis began reflected weaker-thanexpected growth in exports, the weaker euro and resistance by major exporters in Asia and Europe to rebalance their economic growth. Up to now the APEC and G20 leaders have repeatedly charged their trade ministers with finding ways to finish the Doha round. At Seoul, leaders should agree on a balance of interests and direct their negotiators to conclude the Doha round as soon as possible and no later than the end of 2011. There is a unique window of opportunity that will close in 2012 when major elections and leadership transitions are scheduled. Another statement of good intentions will be insufficient. The gains that are available should be locked in. Issues of WTO reform and updating can follow.

Delivering Action Many of the macroeconomic and structural policy priorities were identified in the 2009 task force report on economic crisis and recovery. Concrete commitments are now required by individual surplus and deficit economies and by Asia-Pacific institutions.

The United States: A credible medium-term plan of fiscal consolidation is required, no matter the outcome of the political debates about its composition. This is unlikely until after the November 2010 mid-term elections, however, when the bipartisan, advisory National Commission on Fiscal Responsibility and Reform’s final report comes due. All options should be on the table, including a broad-based consumption or carbon taxes as well as spending cuts. Policy initiatives to increase US exports in the next five years should be consistent with the global trade liberalization agenda.

China: As a major surplus economy China’s relatively fixed exchange rate implies that much of the burden of rebalancing must be carried by domestic policy changes. Domestic policies are moving to encourage the growth of domestic demand but more can be done. Structural reforms in the services industries that allow more competition would raise productivity. Further fiscal reforms to extend education services, infrastructure, public pensions and health insurance to the rural areas, along with labor market reforms that raise wages will help reduce high household saving rates. Likewise, measures are needed to lower excessive savings in the corporate sector, including tax reform and higher dividend payments by state owned companies. Raising artificially low input prices for energy, land, water, the environment and capital will change incentives for industrial production. And allowing exchange rate appreciation will facilitate these shifts, either real appreciation through higher domestic inflation or nominal appreciation.

Other Asian economies: Other surplus East Asian economies could contribute more to global demand by reducing export incentives, increasing domestic demand through infrastructure projects and raising productivity in services industries by encouraging competition. They could make labor and product markets more flexible and encourage household consumption by creating social safety nets and developing domestic financial markets in ways that reduce credit constraints on households and small businesses.

Europe: Since much of the uncertainty about global growth prospects emanates from Europe, crisis management measures are still of considerable importance. The European stabilization fund and unprecedented central bank intervention have bought time for economies like Greece with sovereign debt problems to restructure their finances. But serious questions remain about economic governance in the euro zone where deeper coordination is required to restore and maintain fiscal prudence. Clearly future economic growth will depend on rising productivity which in turn will require politically-difficult and long-delayed product and labor market reforms in a slow-growth environment. Germany as the large surplus economy should stimulate domestic demand to facilitate such changes.

APEC APEC has an opportunity to establish interaction between the global processes of the G20 and regional processes in Asia-Pacific. At the Yokohama summit on November 13-14 APEC leaders could link their five-part growth strategy to G20 priorities. Such an APEC strategy could enhance G20 legitimacy by including more economies. APEC’s recent focus on structural reform lends itself well to helping the region’s economies identify the policy frameworks needed to sustain growth once economies exit from the extraordinary stimulus measures taken in response to the crisis. The APEC High Level Policy Roundtable in Beppu last August identified key areas where the Asia-Pacific can take a leading role in defining the shape of the post-crisis global economy. APEC leaders could commit to deliverables appropriate to surplus and deficit economies in regulatory reforms of services sectors, the financing and provision of infrastructure that deepen APEC connectedness and advance the low carbon economy, and capital market reforms to allocate capital resources more efficiently. Collective action in a number of these areas could be growth engines as the 2009 task force pointed out. Serious consideration should be given to appointing a high-level task force on structural adjustment to work out a regional strategy with milestones and deliverables to be agreed at Honolulu.

Other Asian regional institutions also have potentially supportive roles to play. The ASEAN+3 Macroeconomic Research Office (AMRO) which is being set up as a surveillance mechanism to support CMIM (Chiang Mai Initiative Multilaterization) macroeconomic cooperation could provide institutional support for rebalancing among its members.

Individual governments could also consider setting up independent expert advisory commissions to identify and publicly discuss desirable policy changes that require difficult adjustments, along the lines of the US National Commission. Other examples of government initiatives are Singapore’s Economic Strategies Commission chaired by the Minister of Finance and the Malaysian government’s New Economic Model. These mechanisms could help build public support for the restructuring agenda and reduce the risks of the IMF’s downside scenario that could occur if governments merely opt for quick fixes and declare success.

Conclusion The growing international tensions over recurring global imbalances and the slow movement by governments to reform both structural policies and exchange rate regimes are contributing to an unprecedented crisis atmosphere. Without resolute action by leaders the hard won gains of globalization may be at stake. The Yokohama APEC summit can build on the G20 framework and decisions taken at Seoul. Discernible forward momentum is needed in 2011 or the G20’s credibility and effectiveness will wane. Asia-Pacific economies have a particularly large stake in realizing the IMF’s upside scenario and should push for and support commitments to collective action that support balanced and sustainable global growth.

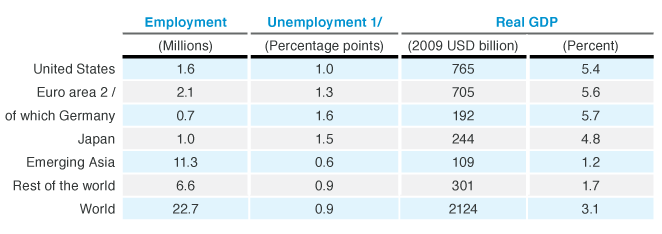

Annex AGDP Growth

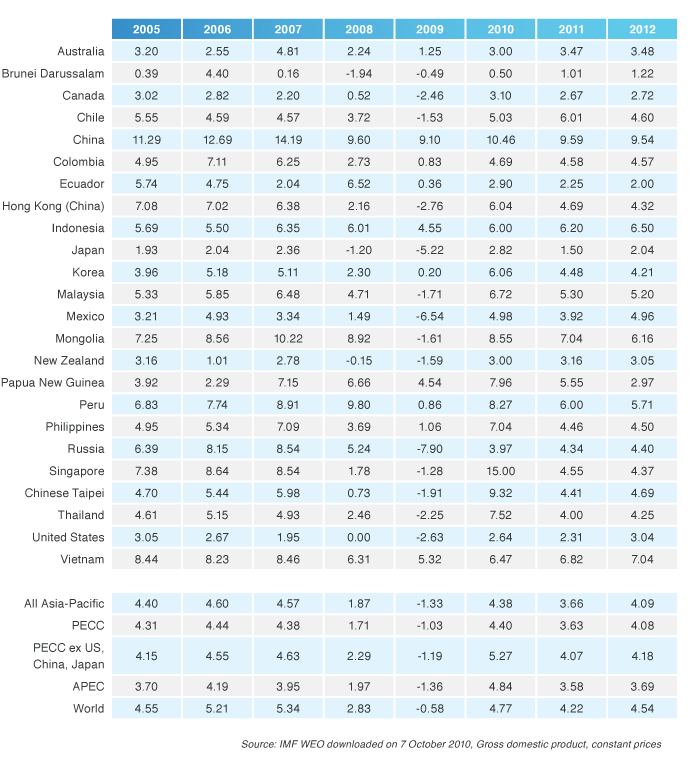

Inflation

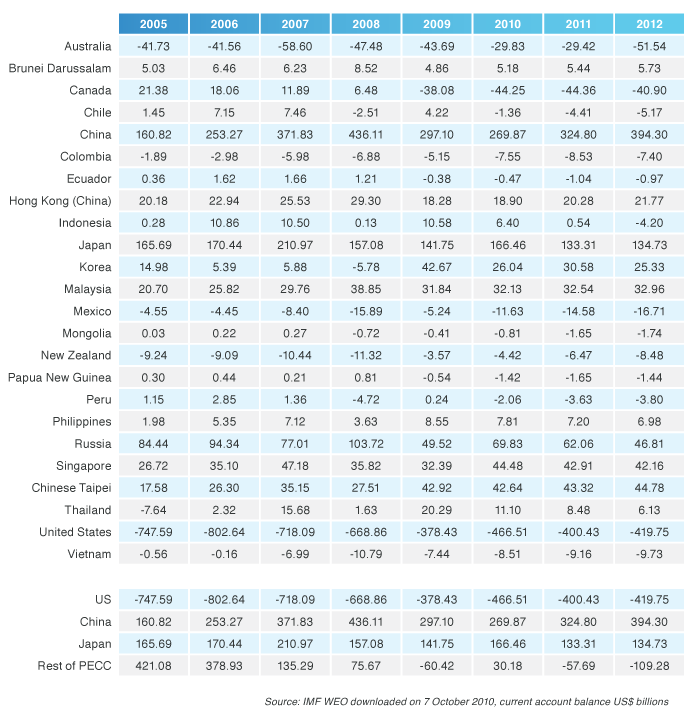

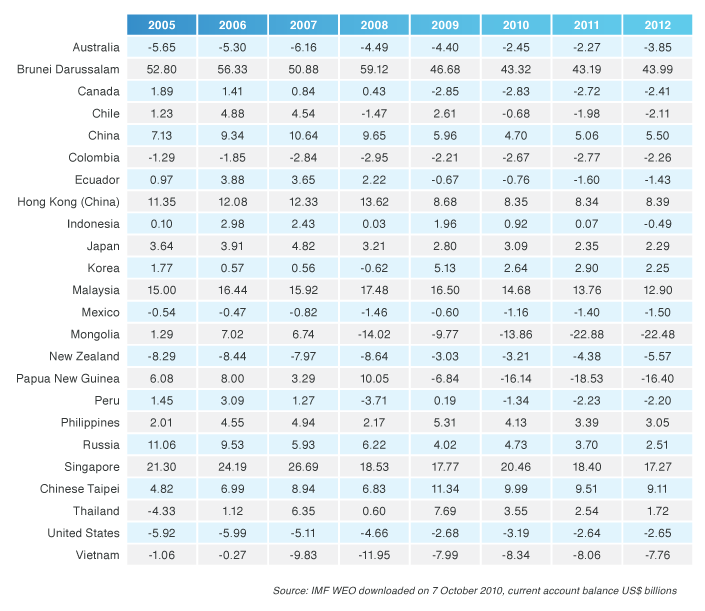

Inflation Current Account Balance (US$ billions)

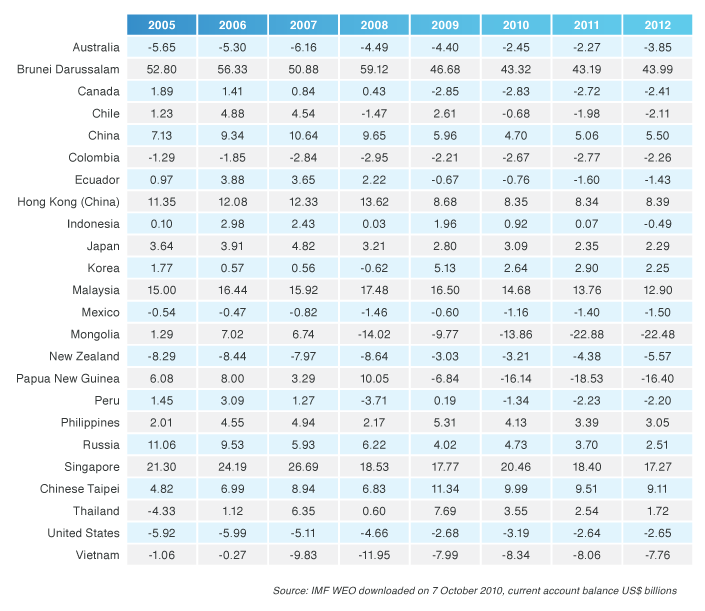

Current Account Balance (US$ billions) Current Account Balance (Percent of GDP)

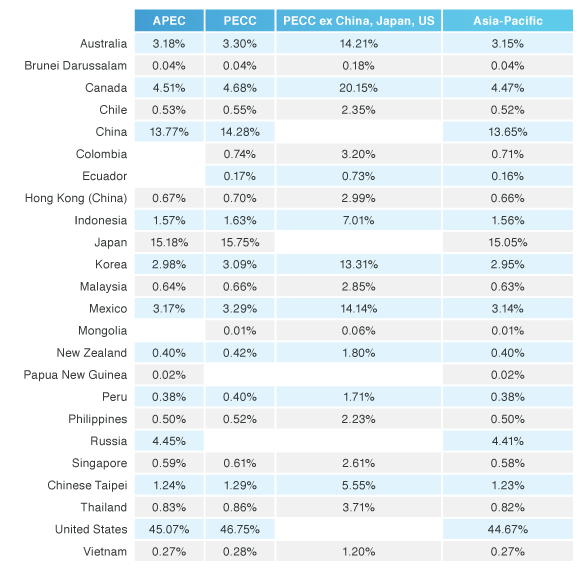

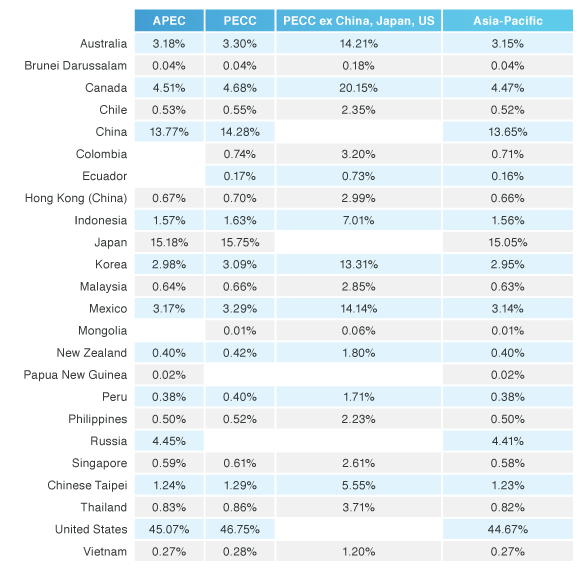

Current Account Balance (Percent of GDP) Weights for GDP Growth

Weights for GDP Growth

Notes:

- Data for members of both PECC and APEC are included here and form the aggregate “Asia-Pacific”

- Members of PECC who are not members of APEC are: Colombia, Ecuador and Mongolia

- Members of APEC who are not members of PECC are Papua New Guinea and Russia

- The weights are based on GDP in US$ at current prices for the past 3 years