ANNEX B - RESULTS OF ASIA-PACIFIC POLICY COMMUNITY SURVEY

This annex presents the findings of a survey of the Asia-Pacific policy community conducted by the Pacific Economic Cooperation Council from 13 August to 19 September 2018. The survey was disseminated through PECC member committees, the APEC Policy Support Unit, the United Nations Network of Experts for Paperless Trade and Transport in Asia and the Pacific (UNNExT), the Asia- Pacific Research and Training Network on Trade (ARTNET); the US APEC Business Coalition; the US National Center for APEC; Groupe Spéciale Mobile Association (GSMA) Asia Pacific; Asia Cloud Computing Association (ACCA); the Internet Society (ISOC) Regional Leadership Group; Consumer Unity & Trust Society (CUTS International); and the Papua New Guinea Committee on APEC Policy Issues (CAPI).

This is not a survey of public opinion but rather, a survey of those whose views influence policymaking, especially at the regional level. As some of the questions tend to be technical, they require a relatively deep knowledge of developments at regional level. However, we do believe that those surveyed include those who are responsible for influencing and often making decisions on various aspects of their economy’s positions within different regional groups.

The guidance for identifying panelists is as follows:

GOVERNMENT

Panelists should be either decision-makers or senior advisors to decision-makers. As a guide, the government respondents in previous years included a number of former and current Ministers, Deputy and Vice-Ministers, Central Bank Governors and their advisors for Asia- Pacific issues, current APEC Senior Officials, and a number of former APEC Senior Officials.

BUSINESS

Panelists should be from companies who have operations in a number of Asia-Pacific economies or conduct business with a number of partners from the region. This might include each economy’s current ABAC members as well as past ABAC members. In last year’s survey, these included CEOs, vice presidents for Asia- Pacific operations, and directors of chambers of commerce.

NON-GOVERNMENT: RESEARCH COMMUNITY/CIVIL SOCIETY/MEDIA

Panelists should be well-versed in Asia-Pacific affairs, being the type of people governments, businesses, and the media would tap into to provide input on issues related to Asia-Pacific cooperation. These included presidents of institutes concerned with Asia-Pacific issues, heads of departments, senior professors, and correspondents covering international affairs.

RESPONDENT BREAKDOWN

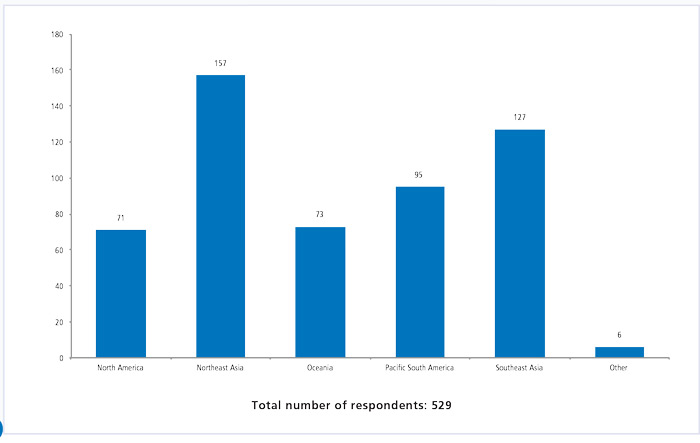

We do not disaggregate results for each economy but rather by sub-regions – Northeast Asia, North America, Oceania, Pacific South America, and Southeast Asia.

- North America: Canada, Mexico, and the United States

- Northeast Asia: China, Hong Kong (China), Japan, Korea, Mongolia, Russia, and Chinese Taipei

- Oceania: Australia, New Zealand, and Papua New Guinea

- Pacific South America: Chile, Colombia, Ecuador, and Peru

- Southeast Asia: Brunei Darussalam, India, Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam

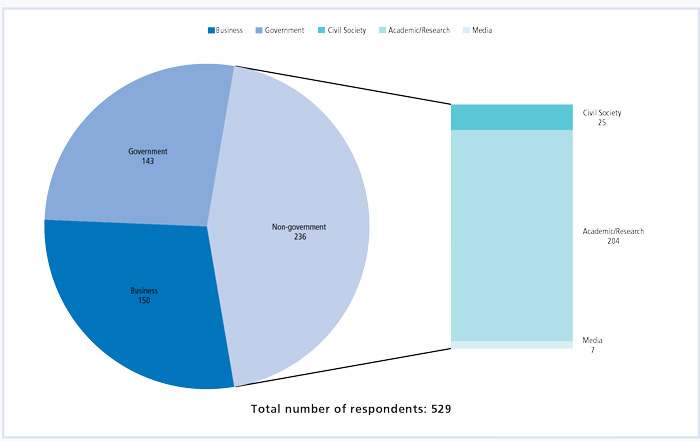

BREAKDOWN OF RESPONDENTS BY SECTOR

BREAKDOWN OF RESPONDENTS BY SUB-REGION

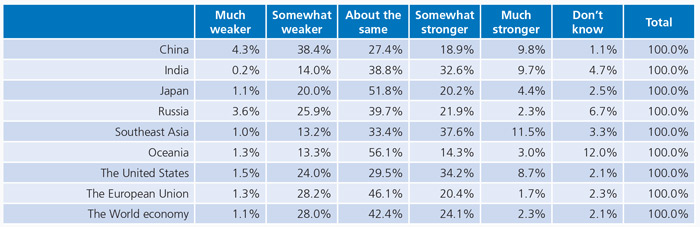

1. What are your expectations for economic growth over the next 12 months compared to the last year for the following economies/ regions? Please select/tick the appropriate box.

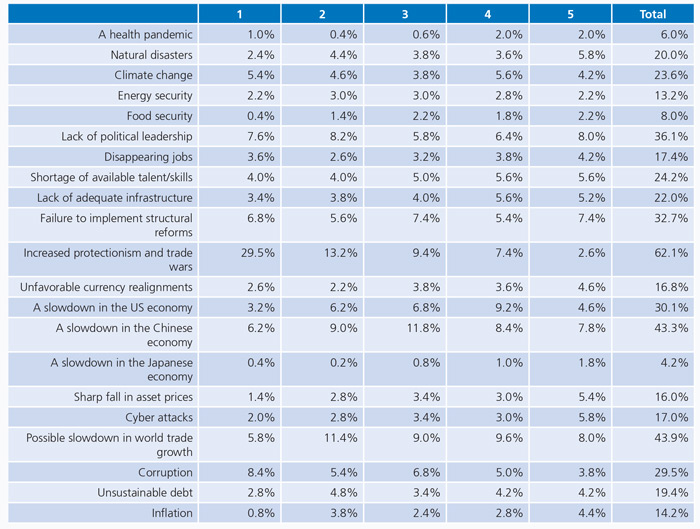

2. Please select the top five risks to growth for your economy over the next 2-3 years. Please select ONLY five (5) risks, using a scale of 1-5. Please write 5 for the most serious risk, 4 for the next most serious risk, 3 for the next third highest risk, 2 for the fourth highest risk and 1 for the least serious risk.

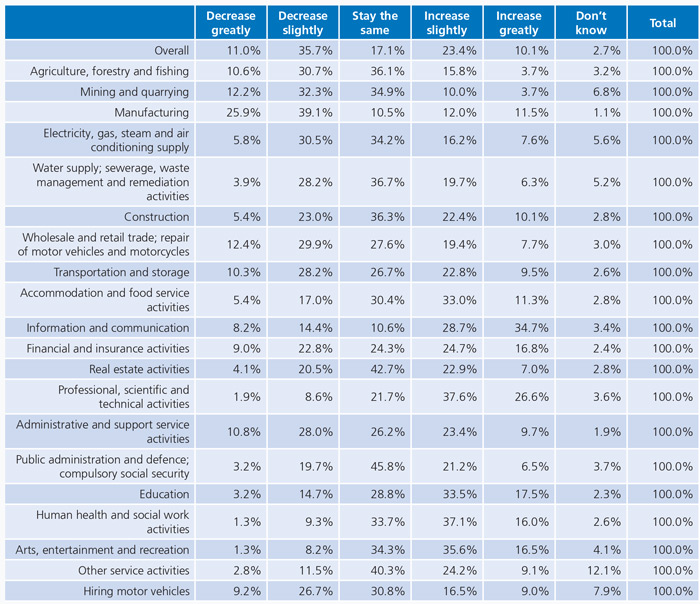

3. By 2030, how do you think new technologies (for example but not limited to artificial intelligence, cloud-computing, 3D printing, blockchain, and advanced robotics) will impact the number of jobs in your economy overall and for the list of sectors below?

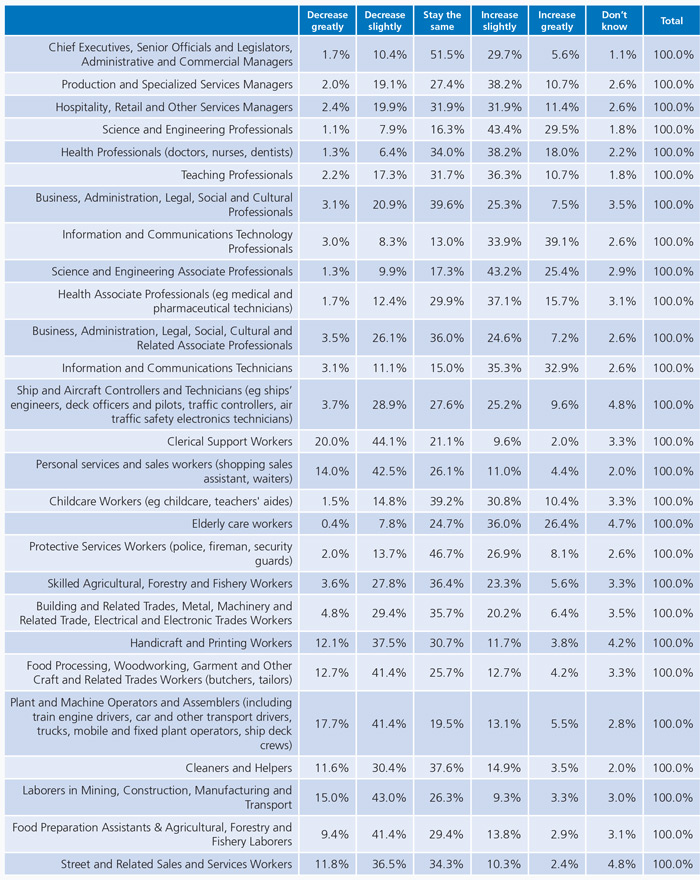

4. Now turning to specific occupations, how do you think new technologies will impact the number of jobs in the following occupational categories in your economy by 2030? (tick one box in each category)

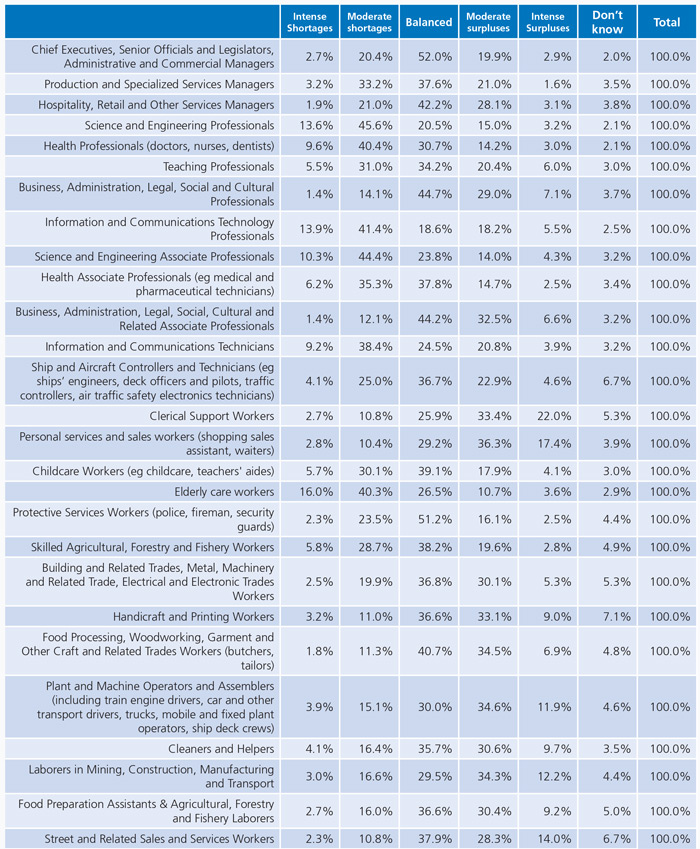

5. Which occupations do you anticipate will develop shortages or surpluses of workers in your economy due to new technologies by 2030 (tick one box in each category)

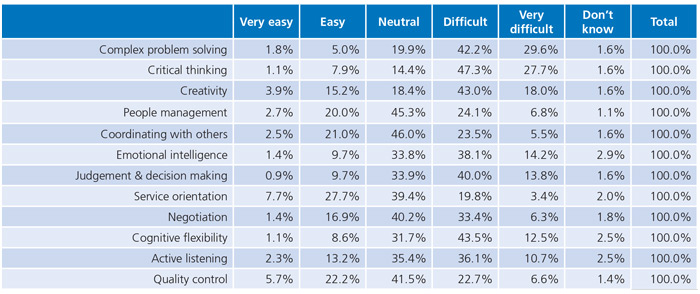

6. Thinking ahead to 2030, which specific skills and abilities do you anticipate will be the hardest to find in your economy? (tick one box in each category)

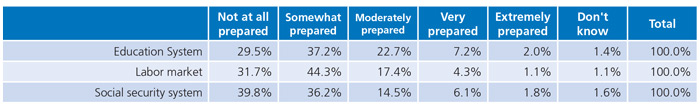

7. Please rank the following in terms of their preparedness to deal with the training, upskilling and possible disruption coming from new technologies in your economy.

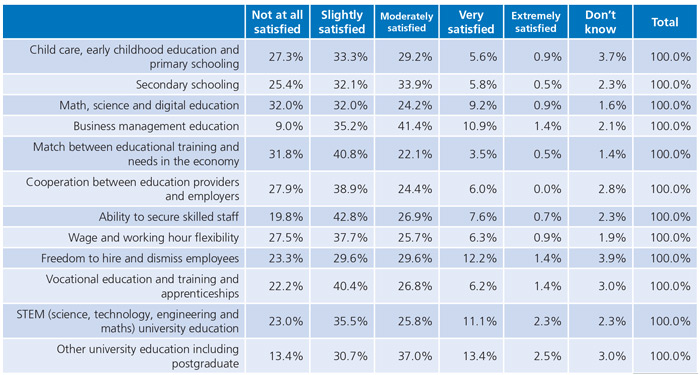

8. More specifically on labor and education issues, how satisfied are you with the following in your economy?

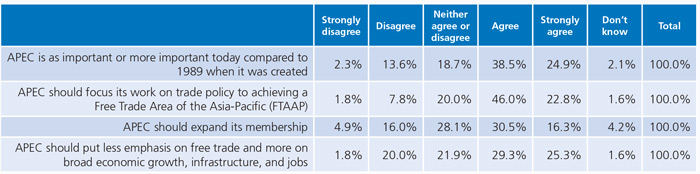

9. Please indicate your agreement or disagreement with the following statements:

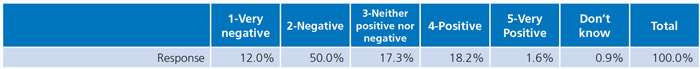

10. How do you assess the political environment for freer trade and investment today? Please tick the box that best fits your assessment.

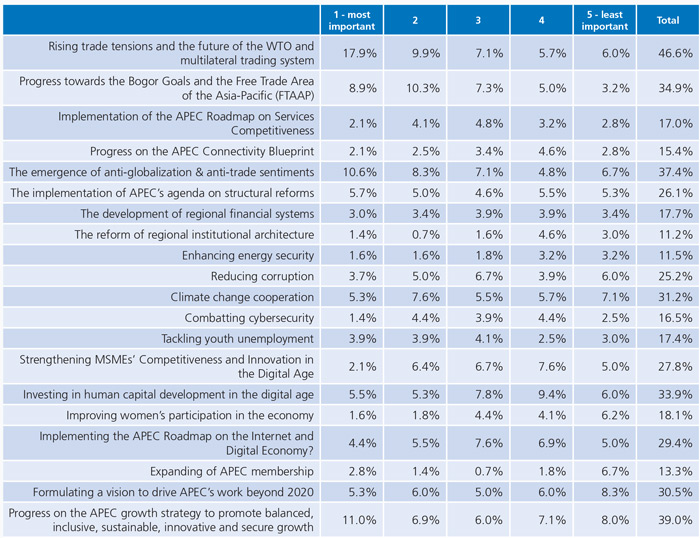

11. What do you think should be the top 5 priorities for APEC Leaders to address at their upcoming meeting in Port Moresby? Please select ONLY five (5) issues, using a scale of 1-5, please write 1 for the issue you think is most important, 2 for the next most important issue, 3 for the third most important, 4 for the fourth most important and 5 for the fifth most important.