CHAPTER 3 -INDEX OF ECONOMIC INTEGRATION IN THE ASIA-PACIFIC *

CONTRIBUTED BY DR. BO CHEN+

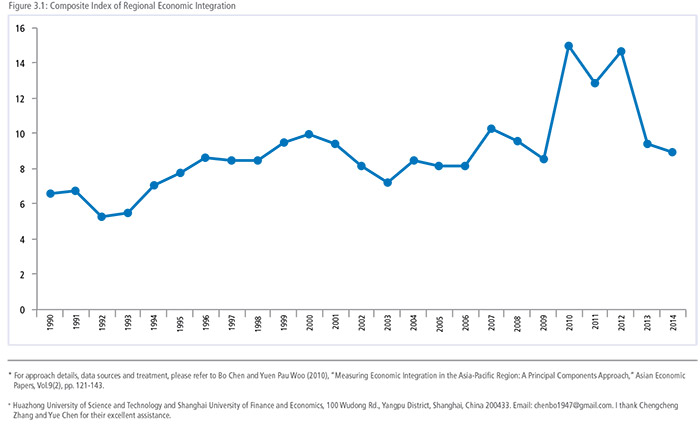

The latest update to PECC’s index of economic integration in the Asia-Pacific region has fallen below its 2009 level. This fall follows the zigzag recovery as well as the influence of anti-globalization in the Asia-Pacific region after the Global Economic Crisis.

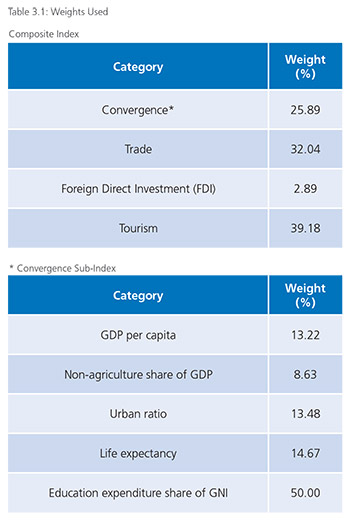

The index measures the degree of integration taking place in the Asia-Pacific region based on intraregional flows of: goods; investment; tourists; and five measures of convergence: gross domestic product (GDP) per capita; share of non-agriculture to GDP; the urban resident ratio; life expectancy; and share of education expenditure in gross national income (GNI). The index was developed in 2008 as a tool to measure the degree of integration taking place in the Asia-Pacific. Regional economic integration has become a core objective of the Asia-Pacific Economic Cooperation (APEC) forum. The process of economic integration is commonly defined as freer intraregional movement of goods, services, labor, and capital across borders.

The degree of economic integration can be analyzed at bilateral, regional, and global levels. Even though the Asia-Pacific region is not covered by a single trading agreement, there is much anecdotal evidence to suggest that it is becoming more integrated. As defined by the APEC membership, the region consists of not only developed economies such as the US, Japan, Canada, and Australia, but also emerging markets such as the ASEAN economies. It is well known that parts of the region are already highly integrated through production networks that facilitate trade of intermediate and finished goods across borders. Since 1998, many economies in the region have negotiated bilateral and sub-regional free trade agreements with partners in the region as well as outside the region. APEC Leaders have also endorsed a proposal to investigate the idea of a Free Trade Area of the Asia-Pacific (FTAAP), which, if successful, would constitute the largest regional trading bloc in the world.

An important feature of the index is that it excludes trade and investment flows among geographically contiguous sub-regional trading partners, namely NAFTA, the ASEAN Free Trade Area, and Australia-New Zealand Closer Economic Relations. It also excludes flows among China, Hong Kong (China), and Chinese Taipei. This is to control for the effect that sub-regional flows may have on the index, whereby a very high degree of integration among, for example, NAFTA economies could result in a falsely high measure of integration with the Asia-Pacific region as a whole.

Furthermore, since trade, investment, and tourism measures are calculated relative to global transactions, the index will rise for a given economy only if that economy’s share of intraregional trade/ investment is growing relative to total trade and investment.

The weights given to each dimension are determined using principal component analysis.1

The convergence measures are premised on the notion that integration will lead to greater uniformity among the economies. Accordingly, more trade and investment among regional partners may not translate into a higher score on the integration index if at the same time the partners are diverging in terms of income, education, life expectancy, urbanization, and economic structure.

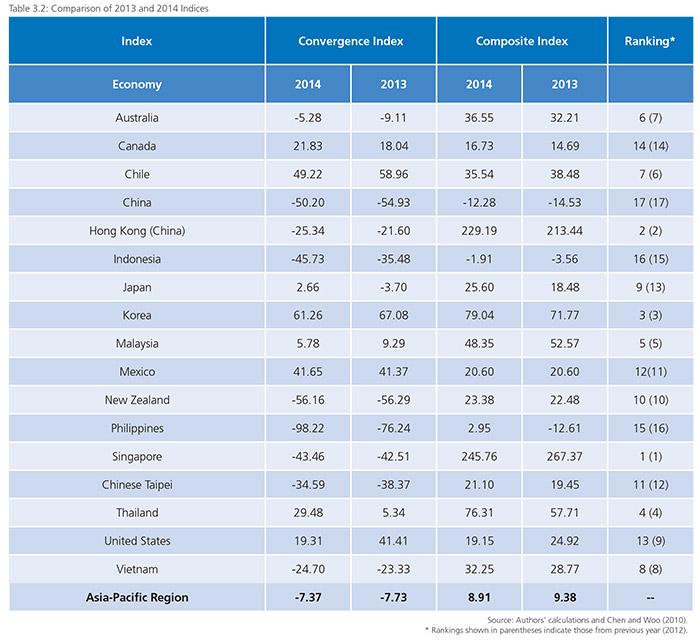

Caution should be exercised in the interpretation of these findings. The measures chosen for inclusion in the composite index are imperfect indicators of “convergence” and trade/investment integration. The rankings in turn should not be read normatively as “league tables” in the sense that a higher ranking is superior to a lower ranking. A low ranking may simply indicate that an economy is oriented more globally than regionally, as is likely the case for China and the United States.

Nevertheless, the change in index value for a given economy over time can be read as a measure of its changing economic orientation. The index value for the region as a whole can also be seen as a measure of closer economic ties among Asia-Pacific economies and as one indicator of APEC’s success.

The 2017 update to the index is based on the latest data available for the selected dimensions from 2014. Missing data were approximated using standard interpolation and extrapolation techniques.

The most recent figures showed a sharp decline to the index, not seen since 2008-2009. Since the Global Financial Crisis, economic integration in the Asia-Pacific has been volatile. The most recent decline mainly reflects the fact that China’s economy has been slowing down significantly since 2012. However, the convergence indices resume its rebound after 2013. The 2014 update by economy shows that the overall convergence process continued to rebound, albeit slightly. As a result, 8 out of the 17 Asia-Pacific economies included in this study became more converged against the average mean level of the Asia-Pacific region in 2014.

Noticeably, Singapore and Hong Kong (China) are still the most integrated economies with the AP markets. As the freest business harbors, Hong Kong and Singapore benefit the most from economic integration in trade, investment, and tourism. The Philippines is falling further behind the regional average, its convergence ranking remains the lowest amongst all 17 economies in both 2013 and 2014. Given the fact that most of the economies were recovering in 2014, the fall in the convergence indices for some economies indicate that these economies are interacting more with those outside the Asia-Pacific region than before. For instance, the United States has its integration index decreased to 19.31 in 2014 from 41.41 in 2012. Meanwhile, another key economy, China, still remains as one of the least integrated economies in this region even though the index shows a small improvement from 2013 to 2014. As a result, the whole convergence index in 2014 improved only slightly compared to its 2013 level, yet the negative sign means the overall convergence level in the Asia-Pacific region is still below its initial level in 1990.

ASIA-PACIFIC TRADE FLOWS

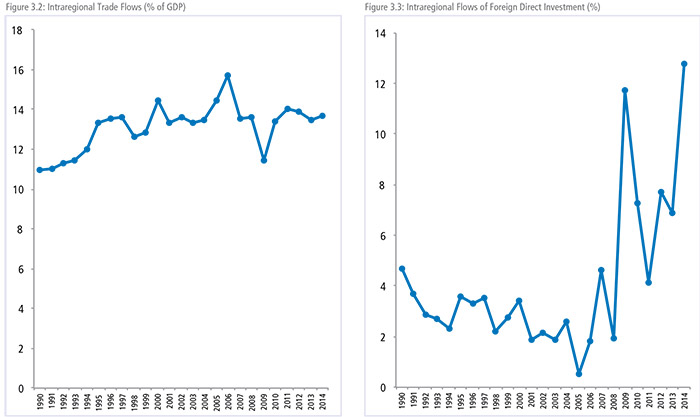

Figure 3.2 shows the share of Asia-Pacific intraregional imports and exports to regional GDP. After various economic stimulus plans, regional economies showed some recovery in terms of intraregional trade flows. Over the twenty-year period, intraregional flows of exports and imports (over GDP) have increased from 14 percent to 15 percent. It should be re-emphasized here that this index discounts flows among sub-regions: the economies of Southeast Asia, North America and those among China, Chinese Taipei and Hong Kong (China).

The share of Asia-Pacific intraregional merchandise trade recovered from the big hit in 2009. However, the recovery was not robust and the recovery trend has been zigzag. Such result is not surprising given China, the world’s largest trading economy and a key player in global supply chain, has been suffering from the pains of economic slowdown and structural change. For instance, there are seven economies that had smaller shares of intra-regional trade (relative to their GDP): China, Hong Kong (China), Chinese Taipei, Singapore, Malaysia, Indonesia, and Korea. An apparent feature is that apart from China itself, these six other economies have close relations with China in terms of supply chain.

FOREIGN DIRECT INVESTMENT

Compared to flows of goods, intraregional flows of investment show a much more erratic pattern. It had a striking volatility during 2008- 2011 due to the global financial crisis. After that, the instability of global and regional economic recovery kept the investors sensitive and conservative. Hence, the rebound during 2011-12 ceased during 2012-13 but eventually resumed strongly during 2013-14. The two largest economies, namely the United States and China, played the key roles. On the one hand, the fact that the United States had a better than expected recovery for consecutive years strengthened the investors’ confidence in investing there; on the other hand, although China’s inward FDI had been slowing down after 2012, an unusual feature is that its outbound FDI surged due to the economic structural changes and many of traditional businesses started to look for reallocation opportunities in other economies with abundant resource and/or labor supply. Hence, the intraregional investment, unlike the pattern of merchandise goods, substantially increased in 2014.

TOURISM FLOWS

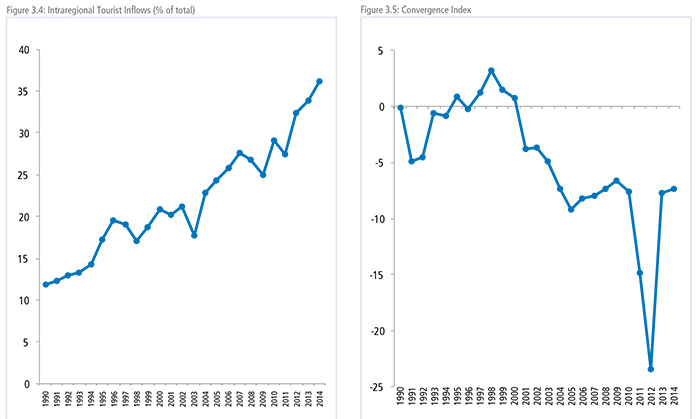

Figure 3.4 shows the recovery trend of the intraregional tourism. It indicates that the intraregional tourist share (to every 1,000 citizens in hosting economy of the sample) increased further to reach new heights in 2014.

Except for the declines seen in 2007-2009 and 2010-2011, intraregional tourist flows have grown substantially from 18 percent in 2003 to more than 36 percent in 2014, the highest level recorded in our index.

According to the data, China remains the largest recipients of inbound regional tourists (excluding those from Hong Kong (China) and Chinese Taipei), which recorded more than 14.7 million tourists. Besides China, there are three more economies that received more than 10 million tourists, namely, the United States, Korea and Japan. Thailand, however, recorded a disappointing tourist figure: the inbound regional tourists (excluding those from other ASEAN economies) decreased by more than 7.3 percent in 2014 compared to its 2013 figure. The declining tourist figures in Thailand may be attributed to its domestic political tensions.

CONVERGENCE INDEX

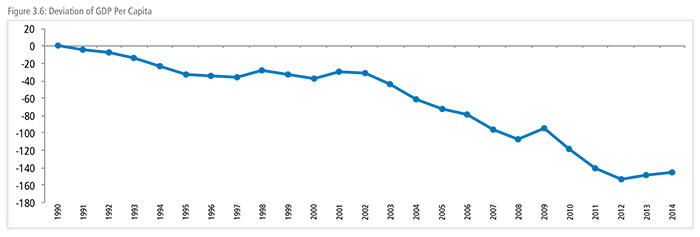

The sub-index of convergence shows that economies in the region have resumed the rebound in 2013, though slightly.

GDP per capita levels in the region had been converging somewhat during the crisis years. However, in 2009, divergence in incomes began once again and continued into 2012. It should be noted here that GDP per capita accounts for just 13 percent of the weight of this sub-index while education expenditure accounts for 50 percent of the weight. Shifts towards convergence in education, even minor ones, could outweigh much larger shifts in income.

LESS DIVERGING INCOMES

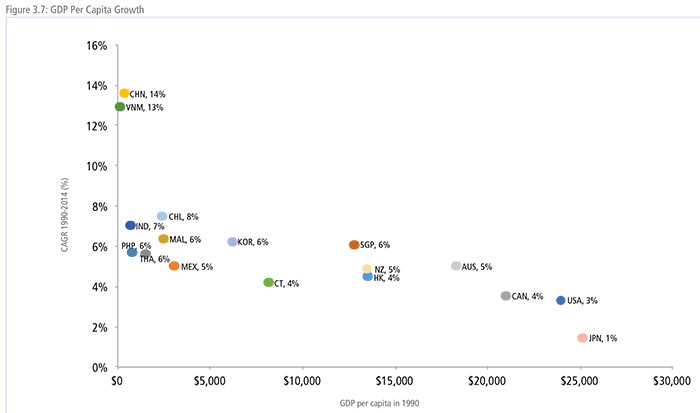

Figure 3.6 shows that the convergence indicator of GDP per capita (measured in international current dollar) decreased in 2009, continuing its sharp decline into 2012. Yet the decreasing trend stopped in 2013 since some of the developed economies such as Japan, Canada, and Australia had smaller GDP per capita measures by US dollars (which was mainly attributed to their currency depreciation).

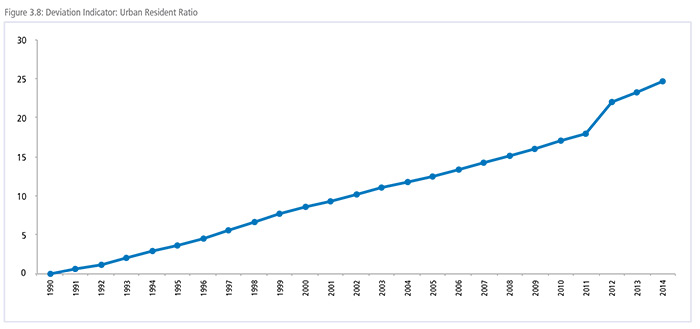

Over the entire index period, the divergence in incomes has been driven by differences in growth rates. Over the 25 years between 1990 and 2014, GDP per capita in the region grew threefold, from US$ 5,500 to US$ 16,000, or at a compound annual growth rate (CAGR) of about 4.36 percent. However, income levels in some economies have grown at a much higher rate than the average in the region while others under the average. For incomes to converge, economies with lower starting GDP per capita levels would need to grow at a much faster rate than those with higher starting levels. Figure 3.7 shows the GDP per capita levels of regional economies in 1990 and the average growth rate over the past 25 years. For incomes to converge, those economies in the bottom left need to move up towards where China and Vietnam are positioned to move to the right at higher pace.

The pace of urbanization in the region has been steady throughout the period as represented by the percentage of population living in urban areas shown in Figure 3.8. In 1990, the urban resident ratio was 65.2 percent with a standard deviation of 21.9. By 2014, the urban resident ratio had increased to 74.7 percent with a standard deviation of 16.5, where all economies showed increase in urbanization and the figures have been converging at a similar rate. As seen in Figure 3.8, this has been a very linear and consistent trend in the region.

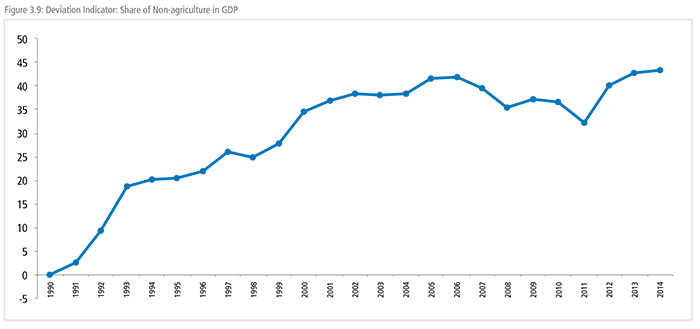

Unlike the convergence shown in the pace of urbanization, the share of non-agriculture in GDP has been much more volatile, with some significant dips taking place in 2007 and again in 2010. However, a strong rebound occurred in 2011 and the convergence level has been back on the rise since. As shown in Figure 3.9, the indicator exceeded the previous peak in 2006. According to the data, the average share of non-agriculture in GDP increased from the previous peak of 94.03 in 2006 to 94.26 in 2014 while the standard deviation across the economies shrunk from 4.78 to 4.66.

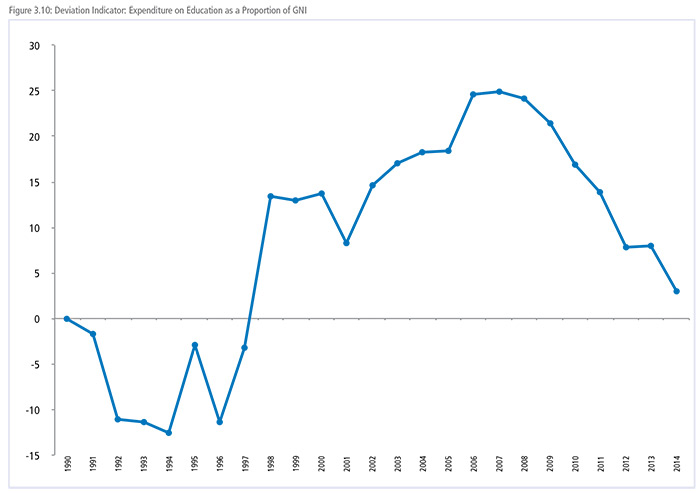

While the proportion of expenditure on education in the region has significantly risen from 3.42 in 1990 to 4.41 percent in 2014, Figure 3.10 shows that its level of convergence has been on decline since 2007. In 2014, 9 out of the 17 Asia-Pacific economies reduced the share of GNI on education. However, the cut was more pronounced in developing economies such as the Philippines.

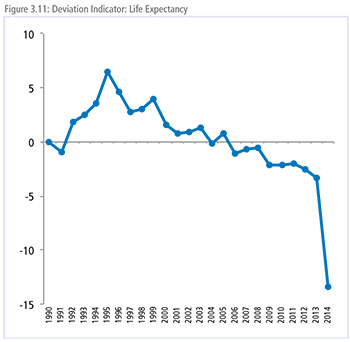

In 1990, the average life expectancy in the region was 73.67 years. By 2014, it had increased by 4.74 years to 78.34, with a standard deviation of 4.0. As seen in Figure 3.11, between 1991 and 1995, life expectancy figures had been converging. However, the level of convergence began to decrease thereafter, signaling that life expectancy is increasing faster in certain economies than others. The level of convergence in life expectancy in the region is persistently below that of 1990 since 2006. The latest update to the index shows a very sharp drop not seen before.

When APEC Leaders set out the Bogor Goals in 1994, they set out a vision through which the region would not only maintain high growth rates but also narrow development gaps. While the region has done well in integrating and overall incomes have increased at a dramatic pace, the index shows that there is a long way to go in terms of closing development gaps. Integration is not an end in itself but a means to ensuring that all citizens can achieve their potentials. A broader and deeper economic cooperation in Asia-Pacific region such as the FTAAP is desired to maintain and accelerate to integration process.