Economic Outlook, 2008-09

At the start of 2008, the economic outlook for the Asia Pacific region is more uncertain than it has been since the 1997-98 Asian Financial Crisis. With the full consequences of the sub-prime loan problem in the United States still playing out, the potential for turbulence in the financial markets to spill over into the real economy remains a serious concern. There are also worries about inflationary pressures in the world economy, speculative bubbles in Asia, and the rapid unwinding of the US current account imbalance. Notwithstanding these risks, the economic outlook for the Asia Pacific region is cautiously optimistic.

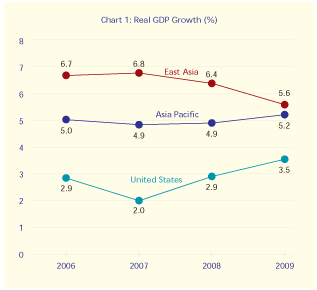

Real GDP growth in 2007 for the region as a whole will come in around 4.9 percent, down slightly from 2006, with East Asia picking up the slack from a slowdown in the United States. Growth in 2008 will remain at roughly the same level, but with the US economy in recovery and many East Asian economies experiencing a modest slowdown due to lower net export growth. The US economy will gain strength in 2009, contributing (along with double digit expansion in China) to stronger regional growth of 5.2 percent.

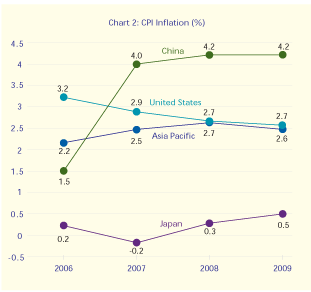

Inflation is on an upward trend for the region as a whole, with prices in China showing the sharpest increase over the last year. Consumer prices for the region will climb a projected 2.5 percent in 2007, accelerating to 2.7 percent in 2008. The increase in regional price levels is expected to take place despite of projected falling US inflation and persistent deflationary pressures in the Japanese economy.

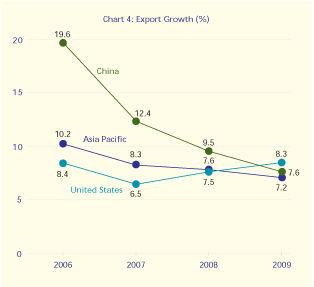

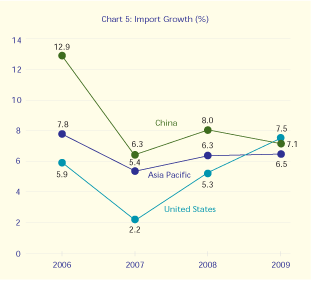

The external sector continues to be characterized by huge current account imbalances across the Pacific. The fall in the US dollar over the last two years is having an impact on the US external balance, with American imports in 2007 expected to have grown by only 2.2 percent. As a share of GDP, the US current account deficit is on a clear downward trajectory.

The deficit was over 6 percent of GDP in 2006 but will settle around 5.1 percent by the end of 2009. However, the dollar value of the deficit will remain very large. After falling from $794bn in 2006 to $760bn in 2008, the deficit is expected to balloon again in 2009, to around $786bn. Over the last year, there has been a growing shift in the interpretation of transpacific imbalances not simply as a US deficit issue, but also as a question of the burgeoning Chinese current account surplus.

The counterpart surpluses of East Asian economies continue to very large, especially in the case of China, which has seen a dramatic rise in its current account balance from US$125bn in 2005 to a projected US$323bn in 2007. Despite Chinese efforts to contain the surplus, including measures such as the gradual appreciation of the Renminbi and the elimination of some export incentives, the current account balance is forecast to balloon to about US$507bn in 2009, which is roughly 10 percent of GDP.

Strong Fundamentals Threatened by Financial Market Jitters

More so than in previous years, there are significant downside risks to the outlook. Some are familiar, including a spike in inflation due to capacity constraints or rising energy prices, as well as a disorderly unwinding of global imbalances accompanied by heightened protectionism.

A major new source of risk is the spillover of recent financial market volatility into the real economy, especially in the United States. The full extent of the damage from the sub-prime mortgage crisis is still being worked out, but it could be as much as $300bn. Together with a falling dollar, the result will be downward pressure on investment, employment, asset prices, and consumer confidence. There is a very small possibility of a severe market crash leading to systemic financial sector crisis and a deep US recession, but it cannot be discounted entirely.

The capacity of East Asian economies to insulate themselves against such a sharp downturn will be severely tested in such a scenario. Ten years after the crisis, Asia is much better equipped to withstand speculative attacks on their currencies, but the Asia Pacific region is arguably more integrated today than it was a decade ago, and “contagion” effects running westward from North America are likely to be as painful as the contagion in East Asia that started in Thailand in 1997.

On the upside, developing countries in Asia, led by China and to a lesser extent India, have been growing very rapidly and have served as a source of demand for the world economy during a period of sluggish US growth. The increase in consumer spending in the two emerging giants through the first half of 2007 added more to global growth than incremental consumer expenditures in the US.

Chinese growth led by domestic demand

Chinese economic growth has continued at a scorching pace, confounding our expectation last year that there would be a slight deceleration in GDP growth for 2007. China is on track to grow at 11.5 percent in 2007 and is expected to continue expanding at around 11 percent in 2008 and 2009. Growth will be led by gross private domestic investment and consumption, with net exports playing a secondary role. The contribution of net exports to GDP growth will fall to under one percentage point in 2009, as import growth catches up with export growth.

The role of personal consumption in the Chinese economy is becoming more important as household incomes grow and pent-up demand for consumer goods is met through the expansion of the market economy. Consumer spending is expected to contribute to half of real GDP growth in 2008 and 2009. This domestic spending power will translate into more imports, but not yet to the point of reducing China’s trade surplus.

The injection of liquidity from persistent current account surpluses, abetted by controls on capital outflows, have propelled local stock and property markets to repeated new highs that defy conventional measures of value. This is a major source of downside risk for the Chinese economy and potentially for the rest of the world. While stock and property markets in China are largely reserved for domestic companies and investors, and therefore insulated, in principle, from global markets, a financial market crash in China could further soak up liquidity from the global economy, sending shockwaves through already skittish markets in the industrialized world.

CPI inflation has taken a sharp upward spike from 1.5 percent in 2006 to a projected 4 percent in 2007, with a further rise of 4.2 percent expected in 2008. A sharp increase in pork prices (due to a shortage caused by an outbreak of blue ear disease) and lower crop yields have pushed up food costs. Increases in housing, education, and utilities prices are also contributing to rising inflation. In August and October 2007, inflation reached an 11-year high of 6.5 percent. To curb price increases, the Chinese government is likely to raise interest rates through 2008 as well as to use a variety of administrative price control measures.

China’s current account surplus has ballooned in recent years and is expected to reach 10 percent of GDP in 2009. Foreign exchange reserves held by the People’s Bank of China are in excess of $1.5 trillion and growing larger by the day. The management of this massive pool of liquidity will be an increasingly difficult challenge for Beijing, not only because of domestic inflationary pressures but also because of the effects that any sharp reversal in the Chinese government’s investment strategy could have on the US dollar and global markets.

The Renminbi is steadily rising against the US dollar, from an average rate of RMB8.0 in 2006 to a projected RMB7.4 in 2007. If current exchange rate policies prevail, the Chinese currency is expected to rise further in 2008 to RMB6.9 and to RMB 6.4 in 2009. Political pressure from trading partners as well as domestic considerations may lead to further and faster widening of the currency trading band, but it is unlikely that the Chinese authorities will allow the Renminbi to float freely in the next year.

Growing Downside Risks for the Japanese Economy

The Japanese economy slowed in the second half of 2007 and is expected to end the year with average growth of 2.1 percent. The slowdown will bottom out in 2008 with real GDP growth around 1.8 percent. A strong rebound is not expected, and the outlook for 2009 is for another year of 1.8 percent growth. The main source of weakness is in the residential construction sector. New housing starts in August 2007 plunged 43.3 percent from a year earlier, following a 23.4 percent year-on-year slide in July. This large drop reflects a tightening of construction standards in June, following revelations that many homes were built using falsified data. Residential investment will continue to be a drag on the economy through the first half of 2008.

Private consumption continues to lead Japanese growth, and is projected to add one percentage point in 2007, 0.8 points in 2008 and 0.7 points in 2009. On the other hand, weakness in the housing sector will mean that gross private domestic investment will contribute only 0.1 points to growth in 2007 and 2008, before rising to 0.5 points in 2009.

Labor market conditions in Japan are increasingly tight, with unemployment falling to its lowest level since 1998. The number of worker payrolls has been growing steadily for more than thirty months. Despite the tighter labor market, average monthly wages have not risen.

To cope with labor shortages, companies have been increasing their share of young workers and re-employing retired baby boomers in a parttime capacity. These new hires are paid relatively poorly, hence depressing average wages. However, a rise in the overall number of workers will boost total household income, which will in turn lead to a gradual increase in consumer spending in the second half of 2007 and through 2008 and 2009. The gradual rise in interest rates on deposits and expected growth in dividends will also contribute to households’ non-labor income.

Price levels as measured by CPI will fall 0.2 percent in 2007 but are expected to rise 0.3 percent in 2008 and 0.5 percent in 2009. Although gasoline prices rose again in the middle of 2007, its effect on CPI is likely to be weak. Prices of other important consumer items such as personal computers and cell phone charges are continuing to fall. The GDP deflator, as an indicator of overall price trends, will fall by 0.7 percent in 2007, reflecting the persistence of deflation in Japan. It is expected to be above zero in 2008 and 2009, but only just so. Despite an expansionary monetary policy since 2004, the effect on deflation has been minimal. The Bank of Japan governor has repeatedly called for the normalization of interest rates at a gradual pace, which will likely mean at least two rate hikes in 2008, but this will depend very much on conditions in the world economy and the actions of other central banks. Downside risks dominate the Japanese outlook. In addition to global factors such as financial market volatility and the health of the US economy, and domestic economic risks such as the weak housing market, there are new doubts about the political will to sustain structural reform initiatives.

SUB-PRIME MORTGAGE CRISIS AND ITS IMPACT ON ASIA

The sub-prime mortgage crisis in the United States highlights the dangers of unregulated, high-risk financial transactions; the interdependence of Asia Pacific capital flows, and the need for international cooperation to resolve structural imbalances.

The Asian financial crisis of 1997-98 called attention, among other aspects, to the problem of unregulated lending by banks and finance companies, supported by collateral that was inflated by a vicious cycle of borrowing and speculation and credit ratings that were unreliable.

The sub-prime mortgage fiasco in the United States was not generated by a currency crisis but it does appear to be rooted in the excesses of poorly regulated aspects of the mortgage market, compounded by the complex securitization of those and other loans, extending the risk to a much wider set of investors.

Because of the difficulties in unbundling and re-pricing the affected asset-backed securities, the full extent of the damage is yet to be known, but some estimates put it as high as US$300bn. While there should be ample scope for financial innovation, the sub-prime crisis is likely to result in greater regulation and transparency in the United States, and getting the right balance of regulation is always a challenge.

The sub-prime crisis affects Asia in several ways. A large share of the subprime mortgage market may be held (directly and indirectly) by private sector and public sector investors from Asian countries. These investors have seen an impairment in the quality and value of their holdings. At the same time, they have taken the additional hit of a falling US dollar. Asian central banks are obviously unhappy to see the value of their dollar denominated reserves fall, but they are also concerned that massive withdrawals from US dollar assets could lead to domestic currency appreciation and a loss of export competitiveness.

With the Federal Reserve expected to cut interest rates at its forthcoming meetings, Asian central banks will face conflicting pressures to either follow suit - and thus hold back the upward pressure on their currencies and the costs of sterilization activities - or to keep domestic interest rates high in order to restrain inflation and to cool overheated property markets even at the expense of export competitiveness.

The sharp decline of the US dollar in recent months will add momentum to the shrinking of the US current account deficit, as a percentage of GDP if not in absolute terms. The unwinding of the "global imbalance" problem may in fact have begun, but no one on either side of the imbalance wants to see a swift correction and "hard landing" in the United States. Nevertheless, if confidence in the US dollar as a reserve currency continues to be undermined, the markets will dictate the pace of dollar depreciation, and it could be a very rough ride indeed. Hence the need for international cooperation in managing an orderly adjustment of exchange rates, especially in the Asia Pacific region, and in addressing the structural changes that are needed on both sides of the Pacific - a greater role for domestic demand in Asian economies and higher savings (public and private) in the United States.

Recovery and Risk in the US Economy

The sub-prime mortgage crisis and its aftershocks have clouded the US outlook. Our forecast assumes that major central banks are successful in supporting credit market recovery and that there is steady improvement in the flow of credit to the conventional mortgage market and to other collateralized investment and consumption activities. Under these conditions, the economy should eke out real GDP growth for 2007 around 2 percent, down from 2.9 percent in 2006. A recovery is expected to kick in by the middle of 2008, and to pick up steam through 2009.

The contribution of personal consumption to GDP growth in 2007 will remain steady at 2.1 percentage points, virtually the same as in 2006. The contribution of private fixed investment, on the other hand, is expected to fall by nearly a full percentage point: a swing from a 0.4 percentage point contribution in 2006 to a 0.5 percentage point deduction in 2007. Most of the decline in the contribution to growth coming from private fixed investment is due to the sharp 15.8 percent fall in residential construction in 2007. Indeed, residential construction alone will knock 0.8 percentage points from GDP growth in 2007.

Net exports are expected to contribute 0.4 percentage points to GDP growth in 2007, compared with a 0.1 percentage point deduction in 2006. This positive contribution from the external sector is due to a very weak rise in imports rather than from expanding exports. In the first half of 2007, imports of non-petroleum goods increased at an annual rate of just 0.7 percent, well below the 8 percent rate experienced during the same period in 2006.

The slump in the residential sector will hit bottom by the middle of 2008, and homebuilding activity is expected to pick up during the second half of next year. The contribution of residential construction to GDP growth improves significantly from -0.8 percentage points in 2007 to -0.3 percentage points in 2008. With improved business confidence, inventory accumulation in 2008 is expected to be positive, resulting in a 0.2 percentage point contribution to GDP growth.

The contribution of real net exports falls from 0.4 percentage points in 2007 to nil in 2008, reflecting a sharp rebound in import growth from the unusually low pace in 2007. Overall, GDP growth is forecast to recover to 2.9 percent in 2008. Inflation, as measured by the all-items or “headline” CPI, is projected to dip to 2.9 percent in 2007, from 3.2 percent in 2006. Core CPI (all items less food and energy) will decline by 0.2 percentage points to 2.3 percent in 2007. Most of the decline in headline inflation, therefore, reflects a smaller contribution of energy prices in 2007. The price of West Texas Intermediate Crude Oil is expected to average about $70/barrel in 2007, up about 6 percent from the $66.22 average of 2006, which was an increase of 17 percent over 2005. Core inflation is forecast to remain steady at about 2.4 percent in 2008.

The recovery in residential housing will kick into high gear in 2009, pushing growth to 3.5 percent. Oil prices are expected to stabilize in 2009, albeit at a high level of around $76/barrel. Robust growth will push core inflation back up to 2.6 percent in 2009, with headline inflation around the same level.

If the current liquidity problems in credit markets persist, the expected recovery in residential construction could be delayed beyond the middle of 2008. There is also concern that if housing prices continue to fall, consumer spending will be sharply curtailed. With private consumption expected to account for more than two-thirds of the contribution to growth in 2008 and 2009, any reduction in spending power will significantly darken the US outlook.

A related concern has to do with the US dollar. In trade weighted terms (as measured by the Federal Reserve’s broad index), the US dollar is expected to have depreciated by around 5.8 percent for 2007 as a whole. Further depreciation is expected in 2008 and 2009, albeit at more subdued rates of between 2.5 and 3 percent. If, however, foreign holders of dollar balances (including many East Asian economies) expect a sharper decline, they may try to minimize their losses by heading for the exit before others, resulting in a self-fulfilling prophecy.

Other PECC Economies

Despite the slowdown in the United States, real GDP growth in 2007 for Southeast Asian economies, Korea, Chinese Taipei, and Hong Kong will be robust, in part due to the strong performance of the Chinese economy. Growth will remain strong in 2008 and 2009, but a decline in real export growth is expected for most economies, due to anticipated weaker external demand. Inflation remains under control but there are concerns about financial and real estate asset bubbles in some economies.

Latin American members of PECC will grow by about 6.2 percent in 2007, much stronger than expected, and nearly a full percentage point higher than in 2006. Growth will moderate in 2008, but remains healthy at 5.8 percent. Peru will be the growth leader with real GDP expansion in excess of 7 percent through 2007-2009. Inflation has been on the uptick since 2006. The Consumer Price Index for Latin American PECC members is expected to rise by 3.9 percent in 2007, and by 4 percent in 2008.

The Canadian economy experienced a slowdown in 2007, albeit by not as much as in the United States. On the other hand, while the US is expected to rebound in 2008, the Canadian outlook is for a further slowdown due to weaker net exports and sluggish domestic consumption due to higher borrowing costs. Australia will grow by a strongerthan- expected 4.1 percent in 2007, slowing to 3.7 percent in 2008 and 3.2 percent in 2009 as the effect of higher interest rates cut into consumer spending and new residential investment. Real GDP growth in New Zealand has been weak in 2007, with full year output growth expected to be around 2 percent. The outlook for 2008 is for only 1 percent growth, due to sluggish private consumption and falling housing investment. The economy should pick up in 2009 with a forecast of 2.6 percent growth.

CHINA’S ROLE IN ASIA’S ECONOMIC RESURGENCE

Rapid economic growth in China continues to set the context for regional economic developments, including the trajectory and pace of integration in Asia and across the Pacific. While China faces many internal challenges, including unbalanced growth, environmental degradation and social unrest, economic fundamentals suggest that growth rates in excess of 8 percent a year could easily extend into the next decade. By some estimates, China is already the third largest economy, after the United States and Japan.

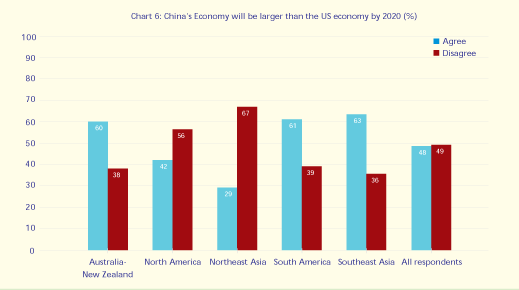

Rapid economic growth in China continues to set the context for regional economic developments, including the trajectory and pace of integration in Asia and across the Pacific. While China faces many internal challenges, including unbalanced growth, environmental degradation and social unrest, economic fundamentals suggest that growth rates in excess of 8 percent a year could easily extend into the next decade. By some estimates, China is already the third largest economy, after the United States and Japan. According to the PECC survey, nearly half of respondents believe

the Chinese economy will be larger than the US economy by 2020. Whether or not this is an accurate projection, the fact that opinion leaders have this sentiment indicates an important shift in the mindset of the region. A majority of respondents already believe that a slowdown in the Chinese economy would have a greater impact on East Asia than a slowdown in the US economy. They may not be far off the mark – in 2007, China’s contribution to global growth in current US dollars was larger than that of the United States.

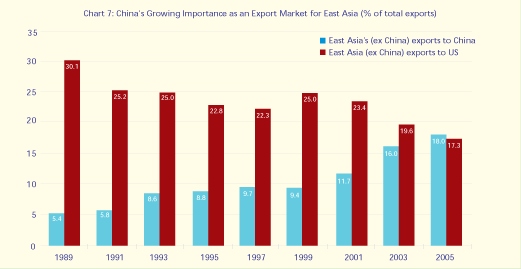

the Chinese economy will be larger than the US economy by 2020. Whether or not this is an accurate projection, the fact that opinion leaders have this sentiment indicates an important shift in the mindset of the region. A majority of respondents already believe that a slowdown in the Chinese economy would have a greater impact on East Asia than a slowdown in the US economy. They may not be far off the mark – in 2007, China’s contribution to global growth in current US dollars was larger than that of the United States. China is already a major source of demand for intermediate goods from neighboring economies, providing much-needed economic stimulus in the region. If the economic slowdown in the United States persists and deepens, the role of China as an alternative engine of growth for the region will be tested.

The Shanghai stock market correction in the first half of 2007 was a measure of global awakening to the impact of China on financial markets around the world. It provided an interesting parallel with the early 20th century response of Europeans who had not realized how important the US had become until events in the New York money market in 1907 reverberated around the world. As it turned out, the impact of the Shanghai correction on global markets was only transitory, and investors eventually recognized the relatively autonomous (and distorted) nature of Chinese equity markets. But there should be no mistaking the growing importance of Chinese, and Asian equities more generally, and their potential impact on global markets — 45 percent of our survey respondents believe that Asian stock exchanges will account for the majority of global IPOs by 2010.