Chapter 2

Survey of Opinion-Leaders

While economic growth seems to have returned to the region, there remain many questions around an exit strategy from the extraordinary measures taken in response to the crisis, and how to put in place policies that will generate long-term sustainable growth. This chapter is based on a survey of close to 400 opinion-leaders from twenty-one Asia-Pacific economies conducted from 29 September to 30 October.

This survey is not one of public opinion, but rather of those who lead opinions. Panelists include senior officials, business leaders, media commentators, and leading scholars/analysts, reflecting the unique membership of PECC. The questionnaire consisted of three sections: economic outlook; responses to the economic crisis; and regional cooperation and integration. On the whole, we believe that respondents selected to participate in the survey broadly represent the community most actively engaged in policy debates on the Asia-Pacific region.

Rising Optimism on the Economic Outlook

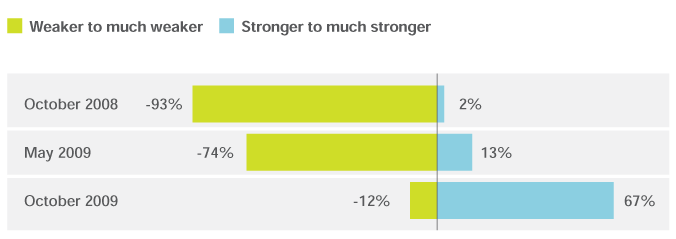

As was discussed in the previous chapter, economic growth has returned to the region. This observation is echoed in the views of respondents on expectations for growth over the next twelve months. Close to 70 per cent of respondents expected economic growth for the global economy to be stronger or much stronger over the next 12 months, compared to only 13 percent 6 months ago and 2 percent a year ago.

Chart 2-1: Expectations for growth of the global economy: in October 2008, May 2009 and October 2009

% respondents who thought economic growth for the global economy would be weaker to much weaker and stronger to much stronger

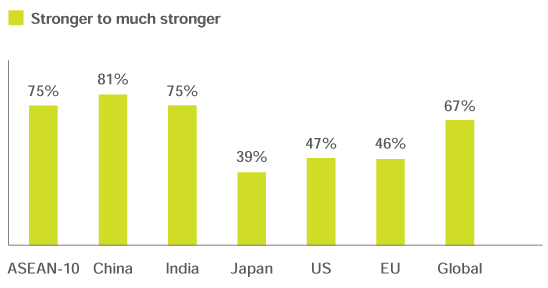

However, opinion-leaders do not expect an even recovery and were much more optimistic about the prospects for growth in developing economies of the Asia Pacific region. Respondents were most optimistic about the Chinese economy with 84 percent expecting stronger to much stronger growth.

Chart 2-2: What are your expectations for economic growth over the next 12 months compared to the last 12?

% respondents who thought economic growth in the following economies/regions would be stronger to much stronger

Policy Responses to the Crisis

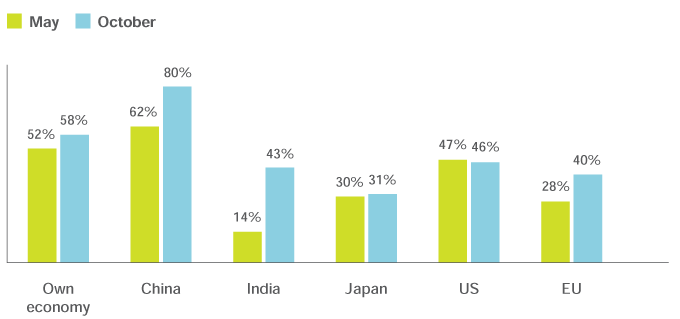

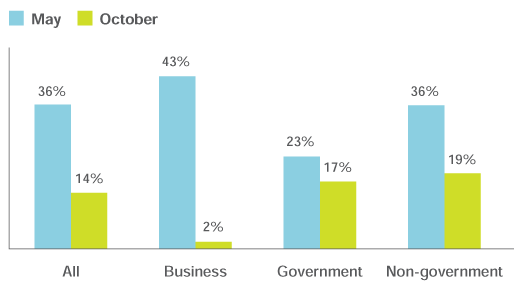

The economies of the Asia-Pacific region were responsible for 84 percent of the global stimulus packages enacted as a response to the crisis. Since the last survey, respondents have come to view the economic and stimulus packages of various countries more favorably, with the exception of the United States.

Chart 2-3: How satisfied are you with the responses of the following economies to the crisis?

(May 2009 compared to October 2009) % respondents who were satisfied to very satisfied

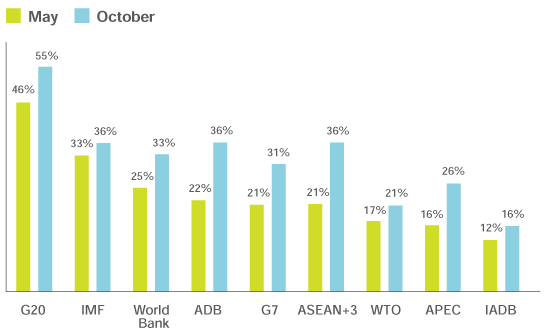

Respondents were less satisfied with the responses from regional and global institutions. The fledgling G20 came out best, with 55 percent of respondents expressing satisfaction with its responses to the crisis. Opinions of institutional responses to the crisis have improved across the board since our previous survey in May 2009, which likely reflects the continued efforts of these organizations to address the crisis and the more positive economic outlook in recent months.

Chart 2-4: How satisfied are you with the responses of the following international institutions to the crisis? (May 2009 compared to October 2009)

% respondents who were satisfied to very satisfied

Even so, opinion leaders held a rather dim view of the responses of the IADB and the WTO, with only one in five respondents expressing satisfaction with the crisis responses of these two organizations. However, in the case of the IADB, a significant number of respondents, 35 percent, did not know what the IADB had done in response to the crisis. This should not be too surprising given that the IADB’s operations are limited to the Americas and the vast proportion of respondents were from Asian side of the Pacific. Protectionism

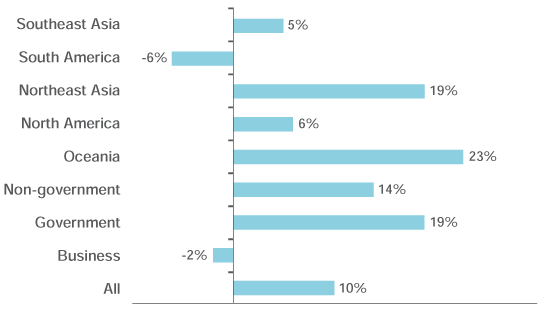

One major concern at the beginning of the crisis was whether governments would resort to protectionism in response to the economic downturn. Although there was overall agreement with the statement that protectionism has largely been avoided, there was divergence between sub-regions and sectors. South America was the only sub-region where more respondents disagreed than agreed with the statement “Economies have largely avoided resorting to protectionist measures in response to the crisis”. Likewise, while respondents from the government and non-government organizations agreed with the statement, the business sector took a contrary view.

Chart 2-5: Economies have largely avoided resorting to protectionist measures in response to the crisis

% respondents who agreed with the above statement minus those who disagreed, by sub-region and sector

Not yet time to exit

Even though there is rising optimism about the economic outlook in the region, opinion leaders were unanimous in their view that it would be premature to exit from the expansionary fiscal and monetary policies taken in responses to the crisis.

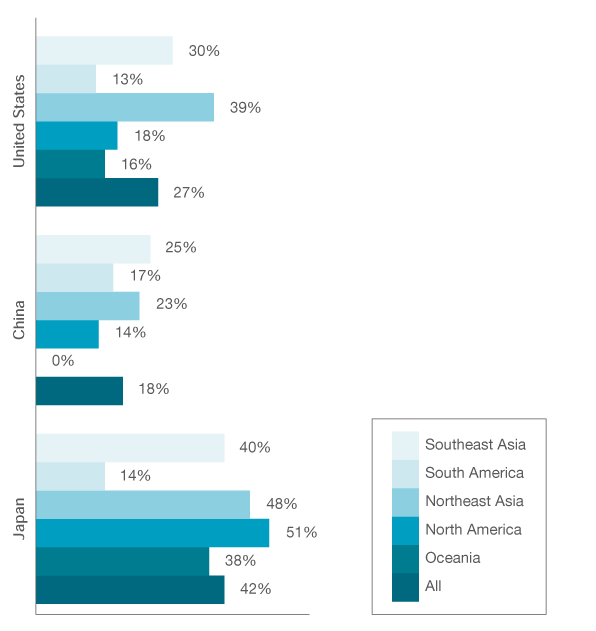

Chart 2-6: It’s time to exit from expansionary fiscal and monetary policies in the United States, China, and Japan

% respondents who agreed with the above statements minus those who disagreed, by sub-region

Respondents were asked if it was time to exit from the expansionary fiscal and monetary policies in the region’s three largest economies – the United States; China; and Japan – the response was a resounding ‘no’. However, there were substantial differences, among the sub-regions on this issue.

- United States: Northeast Asian respondents led in the view that the United States should not exit from its expansionary policies.

- China: Opinion leaders were in agreement that China should exit from expansionary policies, with the exception of respondents from Oceania whose views were evenly split.

- Japan: North American respondents were most resistant to the idea that it was time for Japan to exit from its expansionary stance

Views were much more mixed on whether the US economy would recover from the crisis to retain its leading position in the world economy. While more respondents agreed than disagreed (14 percent net agreement), business respondents were much more skeptical with net agreement of only 2 percent. In response to a similar question six months ago respondents were much more confident that the US would recover to retain its leading position in the world economy.

Chart 2-7: The US economy will recover from the economic crisis to retain its leading position in the world economy

% respondents who agreed with the statement minus those who disagreed, by sector

Most respondents did not think there was a high risk of the world economy falling back into recession next year. Forty percent of opinion leaders disagreed with the statement “There is a high risk of the world economy falling back into recession next year” while 27 percent agreed. Reflecting the more uncertain economic outlook in the United States, respondents from North America took the opposite view, with 44 percent of respondents agreeing with the statement compared to 24 percent who disagreed.

International Policy Objectives for Sustained Growth

The previous chapter of this report discussed the underlying issues that need to be addressed to ensure that the recovery is inclusive, balanced, and sustained. The survey results suggest that there is an emerging consensus among opinion-leaders on what needs to be done, namely to strengthen the regulation of the financial sector; to rebalance the Chinese and US economies; and to increase final goods trade among Asian economies.

Table 2-1: Importance of the following policy objectives for achieving sustained growth in the Asia-Pacific over the next five years.

(Average rating based on a scale from 1= “not at all important” to 5= “very important”)

It is worth noting that “replacing the US dollar with other currencies and/or special drawing rights in foreign exchange reserves” – a popular issue in media commentaries – was seen as the least important policy priority and had an average rating significantly lower than the other policy choices.

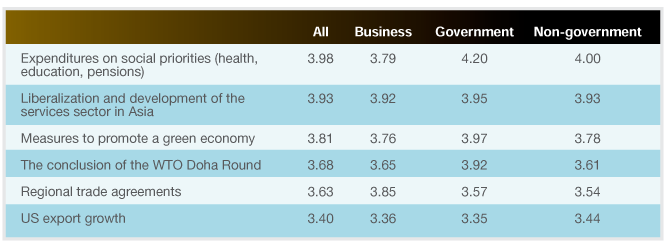

What will drive growth over the next 5 years?

The global economic crisis – and its implications for slower growth in the US economy – have raised some stark questions about the sources of growth for the region in the foreseeable future. In a list of five potential growth engines, opinion-leaders ranked expenditures on social priorities (health, education and pensions) as the top engine of growth for the next five years. This was followed by the liberalization of the service sector; and measures to promote a green economy. Lower in the list but still ranked as important were trade policy instruments such as regional trade agreements and the WTO Doha Development Round of multilateral trade talks.

Table 2-2: Growth Engines in the Asia-Pacific over the next 5 years

(scale from 1= “not at all important” to 5= “very important”)

There were differences in views between respondents from business, government, and the non-government sectors.

- Business respondents ranked service sector liberalization and development as the top driver of growth followed by regional trade agreements and then expenditures on social priorities

- Government respondents ranked expenditures on social priorities as top followed by measures to promote green economies and then the liberalization of the service sector

- Respondents from the non-government sector ranked expenditures on social priorities top followed by service sector liberalization and development and then measures to promote a green economy

Free Trade Agreements

One issue that has been on the regional agenda is large scale plurilateral trade agreements. A variety of combinations of members have been proposed, including an agreement among the ASEAN Plus Three (APT) grouping, an agreement of the East Asia Summit (EAS) members, and an agreement among APEC members.

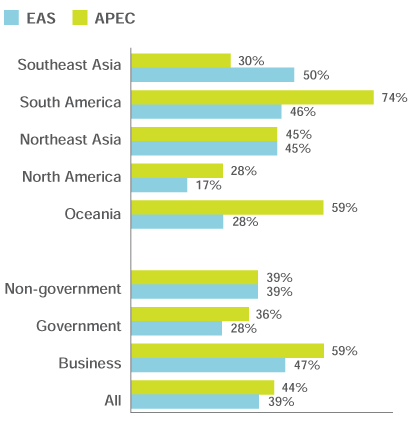

Chart 2-8: A free trade area for the members of EAS/APEC members should be negotiated as soon as possible

% respondents who agreed with the statement minus those who disagreed by sub-region and sector

- Business respondents were much more enthusiastic about regional trade areas than their counterparts from government and the non-government sectors

- Northeast Asian respondents were equally enthusiastic about an agreement for EAS and APEC members

- South American respondents were much more interested in an APEC agreement than an EAS agreement

- North American respondents were least enthusiastic about either idea

Regional and International Cooperation

With the designation of the G20 as the premier world forum for economic cooperation or “the steering committee of the global economy”, the economic crisis may have ushered in a new era for multilateral cooperation. At the Pittsburgh Summit in September 2009, G20 leaders agreed to institutionalize the grouping and committed to a joint meeting of the G8 and G20 in Canada in June 2010, followed by a G20 Summit in Korea in November of the same year. Regional opinion leaders overwhelmingly support this development with 92 percent of respondents agreeing that “the G20 leaders’ process should be institutionalized even after the crisis is over”.

Respondents also agreed overwhelmingly with the proposition that the Asian economies should have a bigger say in the governance of the International Monetary Fund and the World Bank.

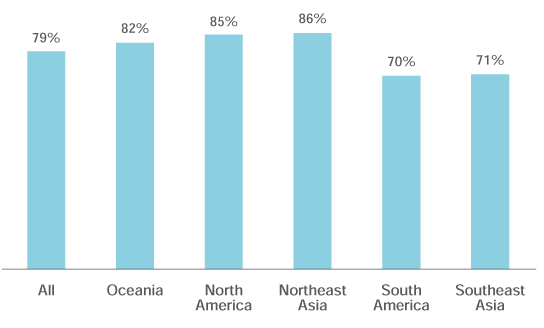

Chart 2-9: The G20 Leaders’ process should continue and be institutionalized even after the economic crisis is over

% respondents who agreed with the above statement minus those who disagreed, by sub-region

Regional Architecture

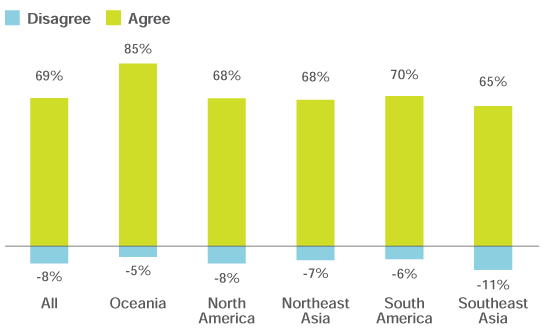

It has been widely noted that while APEC is a useful forum for economic cooperation, the Asia-Pacific region lacks a summit-level forum to address political and security issues. When asked if the region needs such a forum, close to 70 percent of respondents agreed, with the most support coming from Oceania.

Chart 2-10: The Asia-Pacific needs a forum for Leaders to discuss political and security issues

% respondents who agreed/disagreed with the above statement

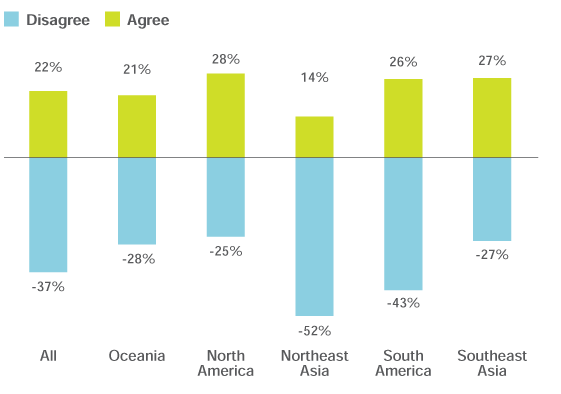

Another issue being debated is the role of Asia-only processes like the ASEAN Plus Three and East Asia Summit vis-à-vis a broader Asia- Pacific grouping. When asked if “the East Asia Summit will eventually overshadow APEC”, 22 percent agreed while 37 percent disagreed.

There were wide disparities in views from different sub-regions. Southeast Asian respondents, representing the sub-region that has been at the core of both Asia-Pacific and East Asian initiatives, were equivocal in their assessment with 27 percent disagreeing and 27 percent agreeing with the statement. Interestingly, the sub-regions of the Asia-Pacific left out of Asia-only groupings differed in their assessments. While North Americans marginally thought that the EAS would overshadow APEC (3 percent net agreement), South Americans disagreed (17 percent net agreement).

Chart 2-11: The East Asia Summit process will eventually overshadow APEC

% respondents who agreed/disagreed with the above statement

APEC Leaders Should Focus on the Economic Crisis

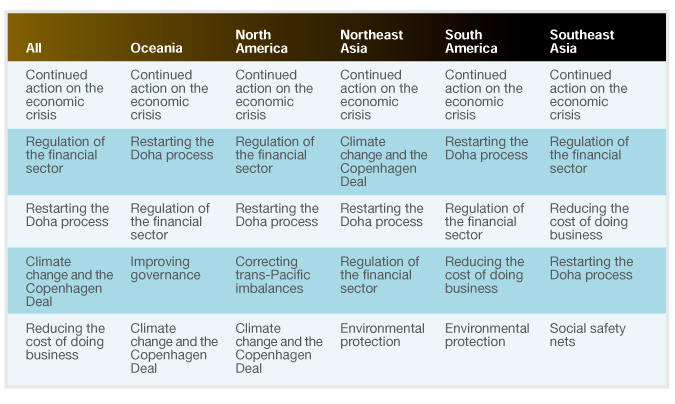

By far the most pressing issue that respondents thought APEC Leaders should take up at the Singapore Summit was: “continued action on the economic crisis”. The top five issues identified by opinion leaders were as follows:

Table 2-3: Top 5 priorities for APEC Leaders to discuss in Singapore, 2009

There was remarkable consistency among respondents from business, government and non-government sectors, with each group agreeing on 4 of the top 5 issues.

As the APEC Summit takes place only a month before the Copenhagen Conference on Climate Change, opinion-leaders have placed it high on the Leaders’ agenda. APEC Leaders discussed climate change at their Sydney Summit in 2007, but APEC has not had any meaningful follow-up since that meeting.

(For detailed survey results, refer to Annex)